It’s easy to get lost in narratives when trying to understand private markets, especially in a market like venture capital which is constantly evolving and changing. There are a lot of conflicting narratives out there regarding the venture landscape - whether we are heading into a recession, are in one already, this is all transitory, the roaring 20’s are just around the corner, etc. All of these stories and anecdotes float around and distort the view of what’s actually going on. Because the industry is so opaque, it’s helpful to dig a little into the data and set one’s bearings. Luckily, there are some data resources we can generally rely on to help us see the forest through the trees (insert more analogies here). I dug into Pitchbook, Carta, and a variety of other data sources to better understand the state of the venture market.

What’s Happening

First, we should ask is whether or not deals are being done. The velocity of capital in the startup ecosystem is a great barometer for understanding the health of said ecosystem. This will let you know if the ecosystem is working effectively - if capital is being invested, it’s because investment theses are working, portfolio companies are exiting, and venture funds are being raised. If capital is not being deployed, that means there is uncertainty in the viability of certain strategies and even the asset class as a whole and things might be mispriced or poorly judged. If it’s way up, the market might be frothy, as deals that are normally not getting done find funding and inflate the market. If it’s way down, the market might be in a recession because startups that are working might not be able to find the capital they need to grow at an appropriate pace. Other data points, like valuations and exits are tougher to use as metrics because they can be heavily skewed with single events (i.e. Figma is acquired by Adobe) or have a lot of end-market-related noise.

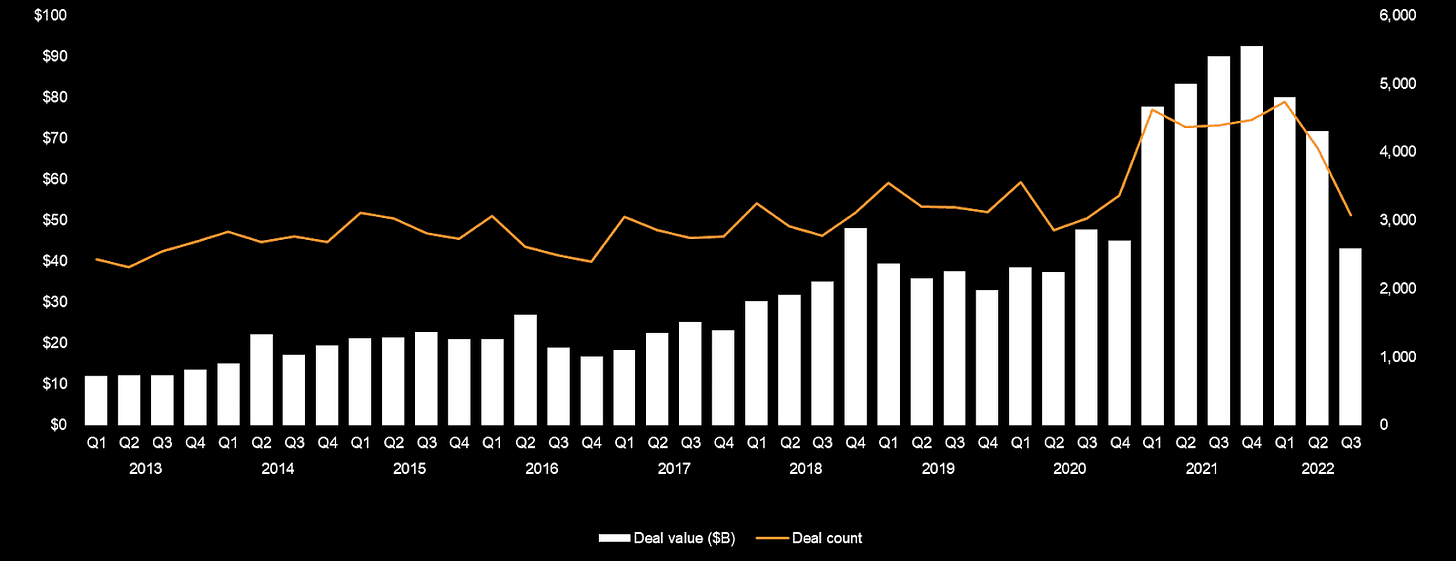

If we look at data from pitchbook, it is clear that the velocity of deals has declined. Deals are certainly still being done, just not at the same rate that they were in 2021, and more in-line with the way deals were being done in 2020 and pre-pandemic.

Companies are still being funded, albeit at a less substantial rate than the breakneck pace of 2021, but as we dig into the data, it becomes more clear what and how is being impacted by this reduction in investing momentum. Later stage round sizes have been impacted the most. Series E rounds have declined 43% year over year, while Series D rounds have declined 22% year over year, and Series C rounds are down 44% year-over year. Notably, $200mm+ rounds are just not being done since the start of Q2 of this year, whereas they were pretty commonplace throughout 2021 and even Q1 2022.

If we swim a little further downstream, we see that earlier stage rounds have been less impacted by the recessionary pressures the venture industry is currently experiencing. Series B round sizes are down 14% year over year, but still pretty well above pre-pandemic levels, while Series A rounds are relatively flat (down 10% year-over-year). Seed rounds, on the other hand, are up 27% year-over-year. While there’s a lot to be unpacked in that number, it’s important to note two things: (1) earlier rounds sometimes tend to have a slightly lagging effect compared to later rounds, so more declines could be coming, and (2) Seed rounds have increased in size every year since 2005.

It’s also worth pointing out that definitions for all financing rounds can be a little fuzzy, especially when comparing them region-to-region. A seed round in the Bay Area looks a little different from a seed round in New York and looks similar to some Series A rounds in Minnesota. So while this is all directionally correct, it’s definitionally lacking some important context.

If we compare these round declines to 2009 (the last time there was a Venture Recession, technically), we find the following data points:

Series A Funding Dipped 40% YoY in 2009

Series B Funding Dipped 42% YoY in 2009

Series C Funding Dipped 47% YoY in 2009

Seed Funding grew through the 2008 Crisis

Deal count and total amount invested was flat from 2007 through 2008, down in 2009, and above trend by 2010

So, in essence, we are on trend already with 2009 for Series C and later financings, but behind trend for earlier stage rounds.

If we turn from round sizes to valuations (again, in which there tends to be a lot of noise), we find that valuations at the early stages are somewhat muted for the start of 2022. Series B, Series A, and Series Seed all remain up year over year through Q2, but some signs of pressure are starting to buck their heads.

In summary - things are shaky in the startup financing market these days. 2021 saw funding rounds balloon and valuations get crazy relative to prior trends. 2022 is starting to see some of these indicators come back down to Earth.

If we move up-market and look at exits in the tech and startup ecosystem, we find that things have effectively shut off. The IPO market has run dry and acquisitions just aren’t happening the way they were in 2021. Q2 2021 saw an astounding $266 billion in exit volume, whereas Q3 2022 saw a paltry $14 billion comparatively (not including the announced Figma acquisition). As a result, later stage companies are seeking liquidity in order to delay having to go public or seek a buyer anytime soon, causing Bridge rounds to be more in vogue. Last year, Bridge rounds represented 8% of venture deals, whereas in Q3 2022 they represented 22%, nearly tripling.

Of course, comparing anything to 2021 exit volume is somewhat of a fools errand, considering the white hot nature of the public markets and the SPAC boom that has effectively been busted. However, even if we compare this year to pre-pandemic levels, we are, at best, in-line with prior trend, if not below it.

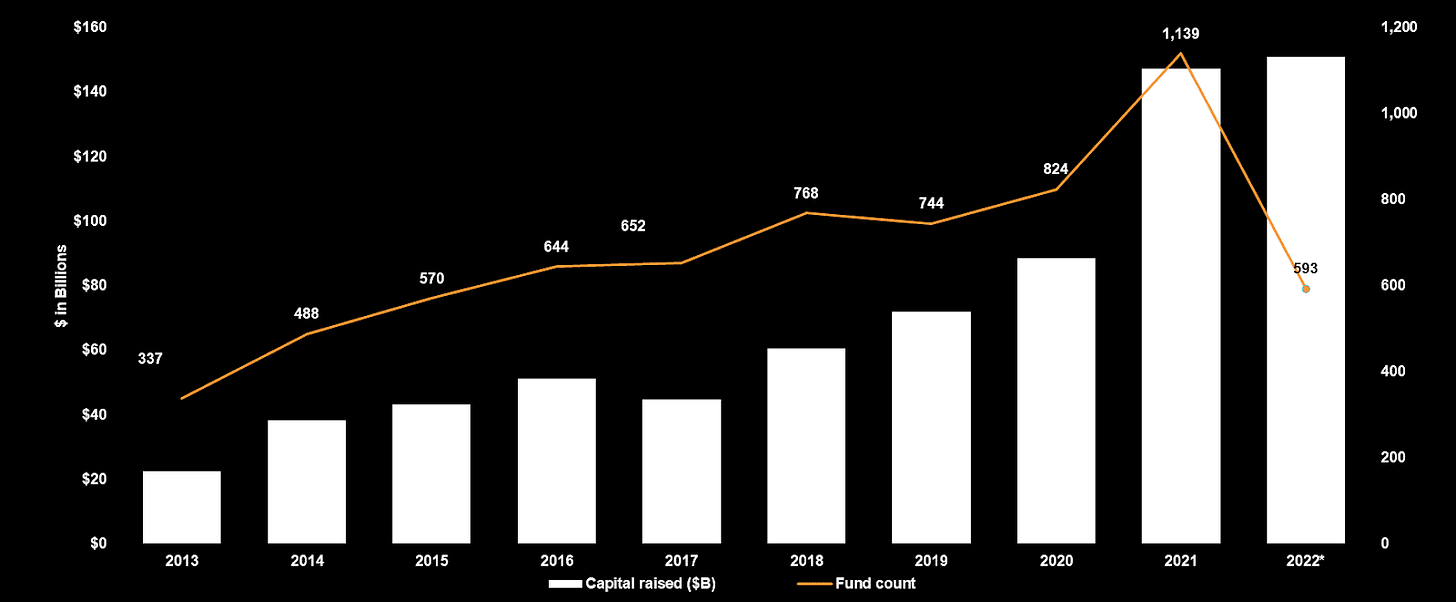

This doesn’t necessarily mean that all is lost in the venture industry, however. Venture funds are still actively fundraising. 2022 has already surpassed 2021 in capital raised, but is well below in total fund count. This likely is due to funds being raised in 2021 and closed in Q1 2022, as there is typically a lag between fundraise and announcement window. But, regardless, there is a lot of capital still in the ecosystem. As recently as Q2 2022, it was estimated that there was $290 billion in dry powder available. Larger funds are amassing war chests as they expect to enter a recessionary period soon.

Tiger Global recently announced a $6 billion targeted fund that they are currently raise - which would be impressive, however, their most recent fund was closer to $12 billion and was deployed in less than a year. However, it is expected that Tiger will shift its focus more towards investing in earlier stage startups, rather than later stage bets.

What’s Next?

All of this data summarizes what I think a lot of folks in the market could already tell you in their gut: we are currently experiencing some sort of cool down in the market, if not a straight up recession. It is, of course, difficult to predict where we will go from here - as the folks at Benchmark say: Our job as investors is to see the present very clearly, not to predict the future. It is important to note that any comparison to previous recession always lands a little flat as there are different causes and factors at play in each one. Regardless of that, however, there are still some general themes we can grab onto and try and see how it applies to our next couple of years. While history doesn’t repeat, it does often rhyme.

So if we look back at the most recent (non-pandemic-related) recession, there are a couple of things we can learn and apply to this current cycle.

First: exits are still likely pretty far off. During the great recession, the IPO markets shut off for most of 2008 and all of 2009, but bounced back to being on trend by 2010. Considering what we learned about the exit environment today, it’s fair to assume that we are at least a couple of quarters into the exit markets being effectively shut off for this cycle. As a result, it’s fair to assume that the exit markets over the next 4-5 quarters will continue to be weak. It’s probably another year or so before we start seeing companies exit at a more appropriate pace.

Second: we should expect valuations of private companies, regardless of stage, to decline over the near term. There is a generally accepted thought going around that the flat round is the new up round in the growth stage market. While early stage rounds have still been relatively unaffected, there is trickle down effects as those early stage companies do eventually want to grow into growth stage companies. So while performance is still important and capital is still available at certain stages, it should be hard to get, making the cost of capital higher, and thus reducing valuations.

Third: despite the above point, I still think things are going to be much less severe at the Seed and Series A level. Historically, Seed has been a very resilient asset class due to the long term nature of the investments it is comprised of and because of the inherent risk nature of Seed. So while valuations and round sizes may come down, I don’t expect it to be as radical as what is already occurring in later stages.

Fourth: for startups, timing is everything. Startups that do a good job of raising capital before a recession hits typically go on to have some of the most successful post-recession exits. I ran a quick study to see how true this was and it did appear that most of the best exits in the post dot-com era and post-great recession era had almost all universally had that in common.

Fifth: weakness is exposed. Trend investing tends to lose steam and bad unit economics go wildly out of favor. There isn’t a universe where a company like WeWork raises billions of dollars if it was founded several years later and actively seeking growth capital in 2022 and 2023. Likewise, hip trends tend to get blown out of the water as investors focus back on fundamentals - things that actually make money (however you want to define that). The Dot Com bust led to an array of ecommerce companies that lost money on every sale getting radically wiped out.

Sixth: Execution is what matters now (and it always has). It goes without saying, but great startups are constantly being built, no matter the era. That doesn’t change now.