Veeva Systems is the monster SaaS that most people think of when they think of vertical software. The Company was built on a simple premise: life sciences companies have radically complex processes and procedures that can make traditional horizontal software tools difficult to implement. It’s the kind of software company that is so industry-specific, that most company outbound marketing is just targeted at recruiting talent to work for the firm because anything that is even remotely specific is getting sent to an industry inside directly.

The Company is a cloud-based SaaS solution that provides customer relationship management (CRM) solutions specifically designed for the life sciences industry. It was founded in 2007 by Peter Gassner, a former senior vice president at Salesforce.com. The idea for Veeva came to Gassner when he realized that the life sciences industry needed specialized CRM software that could help them manage their complex relationships with healthcare providers, patients, and regulatory bodies.

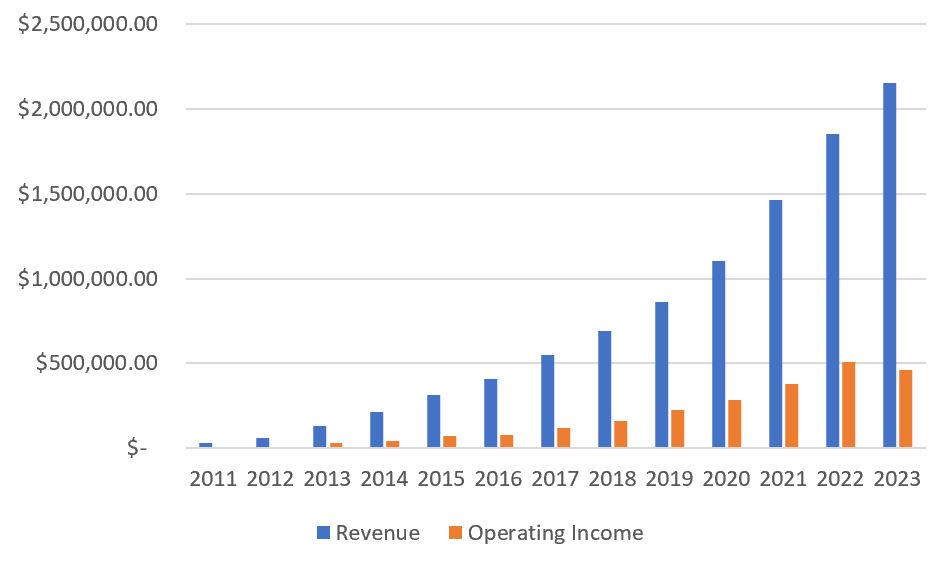

According to Gassner, the Company was not popular among VCs when they first got started because the idea seemed frivolous - even if it could gain market share against the existing cloud-CRMs at the time, it would never be a massive company - there are only so many pharmaceutical and life sciences companies out there to buy their product from - how could they reach scale? But, the Company grew like a weed anyway. At time of IPO, they had ~170 distinct customers, including 33 of the top 50 largest pharmaceutical companies - and ~$130mm in annual revenue, once again showing that venture consensus is not all it’s cracked up to be. Not only that, but the Company has continued to grow, reaching $2.1 billion in annual topline as of the end of January 2023. The Company went public in 2013 with a valuation of $4 billion, and since then, it has continued to expand its offerings and customer base. At it’s peak in 2021, Veeva Systems had a market cap of over $40 billion and was one of the fastest-growing enterprise software companies in the world.

Problem: The problem that Veeva Systems is trying to solve is the lack of specialized CRM solutions for the life sciences industry. Prior to Veeva, many companies in this industry had to rely on generic CRM software that didn't take into account their specific needs and regulatory requirements. Pharma companies still have to find a way to manage their relationships with healthcare providers, track sales and marketing data, and ensure compliance with regulatory bodies such as the FDA.

If you are curious just how complicated the pharma industry really is, I recommend you take a stroll around the FDA’s Form’s & Submissions Requirements page. Post-COVID, most people have become much more aware of just how labyrinthian it is for a drug to get approved. While most of those regulations are for good reasons, that doesn’t change the fact that it is really hard to get a drug approved - not just from a data perspective, but because of the sheer amount of man-hours and know-how required. To put that into even more perspective, check out this summary from the folks at Nationwide Children’s Hospital on what it takes to get a drug approved.

But it’s not just getting it approved that makes the life sciences sector so difficult. There are tons of rigorous FDA regulations that need to be maintained once a drug is on market. And while some drugs are sold over the counter (~$45 billion annually per year), the larger share of the market is prescription (accounting for $378 billion annually). So selling and marketing these drugs is more complicated than most sales processes - you have to go through health care organizations - health systems, doctors, pharmacies, advocacy groups, payors, etc

When you break it down, who really is the customer for a life sciences company? And I don’t mean that to sound accusatory - most of the regulations in place for the life sciences industry are in place for a good reason. However, the many different stakeholders involved in the sale of a single drug all have a role to play. But keeping track of all of this on a traditional CRM functionality would be basically impossible.

Solution: Luckily for the pharma industry, thanks to Veeva, they don’t have to do that. Veeva describes it’s product as the Life Sciences Cloud, but all that means is they have purpose-built other horizontal SaaS tools to better fit how the pharma industry works. Veeva has commercial solutions that allow pharma OEMs to better engage with various stakeholders through various channels, including sales and marketing. It also has R&D solutions that allow for drug developers and the drug development industry to better manage regulatory workflows. The company even has solutions developed specifically for clinical research organizations. On top of all of that, because they have captured such significant market share, they are collecting incredible troves of data, which they can refactor and provide back to the industry in a variety of ways, including network-related tools.

The Company’s big product lines are broken out into several different functions:

Development Cloud - for R&D organizations to better manage workflows in the drug development process. This includes tools provided to various members of the clinical trial workstream to share and collaborate on important tasks related to running clinical trials.

Commercial Cloud - for pharma manufacturers to more effectively commercialize their drugs once they have received appropriate approvals. This includes tools for sales, medical affairs, and marketing. This was the original product of Veeva and is the most classic version of a CRM that the company operates. At time of IPO, it made up 95% of revenue.

Veeva Data - selling this data in a compliant and appropriate manner for a wide variety of customers, not even just within the pharma industry.

The Company also has business consulting services, which are separate from the more traditional SaaS professional services function. Business consulting for Veeva is an additional way for them to monetize their unique data, technology know-how, and industry best practices to ensure that customers use their tools and data more effectively.

Customers: Basically the entirety of the pharmaceutical industry. Remember how I said that at time of IPO, they had 170 customers? Today that number is 1,388.

Questions: Hard to ask questions of a company whose growth chart looks like this:

They did, notably, hit a hiccup in FY 2023, which is worth further investigation, but this is a Summary Memo, not a detailed memo - go find that somewhere else!

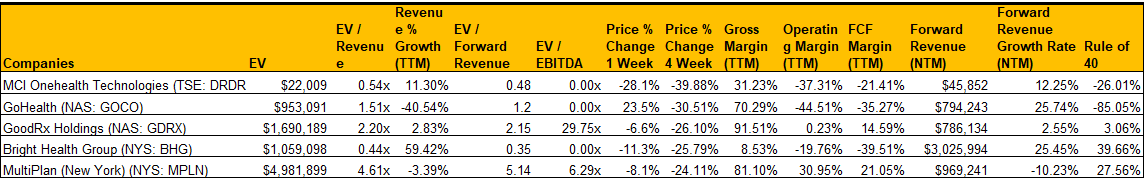

Top 10 EV / NTM Revenue Multiples

Top 5 Weekly Share Price Movement

Total Comps List

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.