The Gaming<>Enterprise Chasm

It's Dangerous to Go Alone! Take This.

People have been hypothesizing about the inevitability of Virtual Reality for a long time. In the last several years, the conversation has started to heat up, with some notable large tech companies focusing (or entirely pivoting) significant investment dollars into the industry. Of course, there have been some notable failures (or, bad trial runs, depending on who you ask) in the XR (short form of AR/VR) space, such as Google Glass, Oculus Rift, and of course, many of us have seen real world examples of VR Fails. But an XR optimist would just let you know that we are still so early and that this is exactly what happened to the personal computer in its early days. If you spend enough time listening to acolytes, you have likely heard this refrain about a plethora of other technologies as well.

However, it’s easy to fall into the trap of making broad sweeping comparables in the tech world (i.e. crypto is the next internet), but it’s hard to deny that there are some striking similarities between VR and early PC days. In 2017, 80% of virtual reality developers classified themselves as hobbyists, meaning they were doing this for fun, bearing striking similarities to the Homebrew Computer Club. Of course, there are a lot of hobbyist organizations that aren’t worth paying attention to - the old model shop that was in my neighborhood growing up is now a shoe repair shop. But when it comes to tech, hobbyists are where a lot of great hardware and software breakthroughs occur. My friend Erik Berg reminded me of Chris Dixon’s article What the smartest people do on the weekend is what everyone else will do during the week in ten years. In it, he says “Hobbies are what the smartest people spend their time on when they aren’t constrained by near-term financial goals”. Interestingly, he lists a bunch of potential hobbies to turn into big things at the time (2013) and he doesn’t mention VR. Although that’s a potential miss on his part, for VR, it’s not really just hobbyists participating anymore.

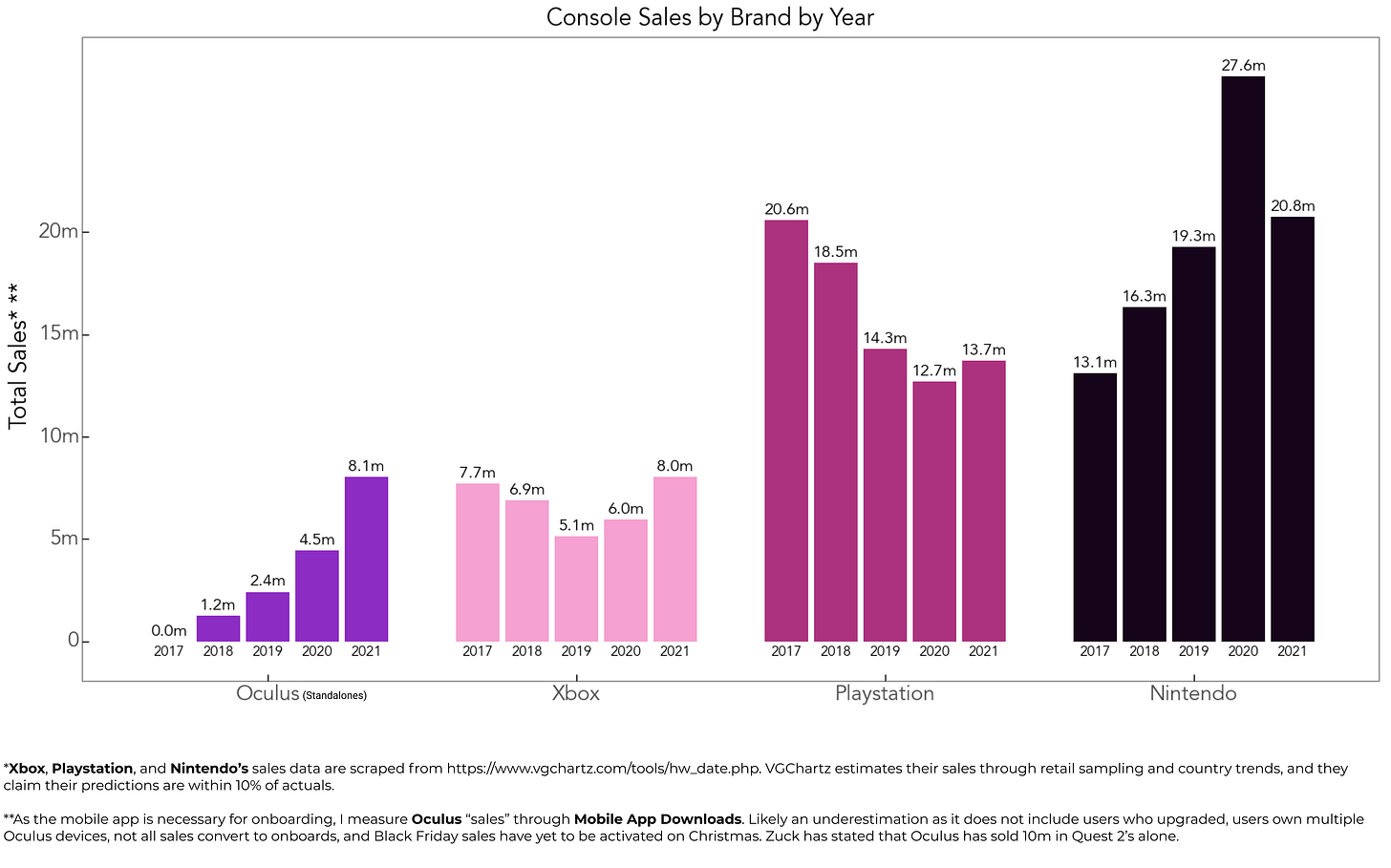

Meta’s Oculus Quest 2 outsold Xbox’s console system in 2021, a potential watershed moment for virtual reality in the gaming world. While it’s remarkable sign of achievement for the Meta organization (and Zuckerberg’s commitment to the metaverse), it should be noted that there is still a long way to go before the Quest 2 catches PlayStation and Nintendo. Some AR gaming acolytes might tell you that it’s only a matter of time before Oculus subsumes the entire gaming market, making the Nintendo Switch or PS5 go the way of Atari. Others would say that overtaking Xbox is not as impressive as it sounds as the Microsoft console has faced some product headwinds as well as supply chain issues in 2021. No matter how you shake it, Oculus had a big year last year and has clearly started to break into the mainstream.

What’s more, the Oculus has shown signs of continued acceleration. Typically, gaming consoles see a big spike in sales when a new product is released (see 2020, Nintendo), but then taper off as market penetration becomes saturated. The Oculus Quest 2, however, doubled its sales year over year, even though the Quest 2 was originally released in 2020 (Quest 1 was released in 2018). This is a clear sign that while the initial release was well-received, there is accelerating market acceptance for the Quest 2 product and just VR as a whole.

And it’s not just the Oculus family of products that are showing signs of strength, as VR systems in general are growing more and more popular. There were approximately another 3.1 million headsets sold last year (non-Quest 2 variety), bringing the total headset sales number up to 11.2 million, a nearly doubling of unit sales year-over-year.

Naysayers might be thinking: “Okay fine, it’s not just hobbyists. But it’s still only gamers! Who cares about those weirdos! Enjoy your Doritos (100 million bags are consumed daily) and Mountain Dew (a brand worth $2.7 billion) in your basement, nerds! Gaming isn’t a big enough industry to support meaningful capital returns!” First of all, those naysayers needs to relax and tone down on the exclamation points. But also, after putting aside the fact that gaming is a massive industry worth paying attention to for any investor worth their salt, they still could potentially be onto something. It’s hard to tell how much VR/AR has crossed the gaming<>enterprise chasm.

Right now, Meta does not breakout how it’s Oculus Quest 2 product is being used - for games, social experiences or commercial use cases. However, most assumptions within the industry feel as though the vast majority of XR headsets are used for gaming and social, while a small portion are used for commercial use cases. It’s easy to look at the XR market and think that it’s trivial - kids and uninspiring adults will keep buying these toys, even though they don’t have any real use cases outside of gaming. You might even argue that this boon was more a result of a booming consumer balance sheet due to various COVID-related cash infusions. Whatever the argument, there’s a decent chance it’s wrong.

A lot of key technological shifts start out as toys and games. One of my favorite essayists, Benedict Evans, wrote an excellent article on the topic back in 2017 that is as true today as it was back then - Not Even Wrong. In it, he details that many great inventions start out looking like toys, but eventually become core new technologies. There are plenty of toys that just stay that way as well - they don’t really advance into anything worthwhile. Evans asserts in his essay that the reason some toys advance is that others don’t is that because toys still need a reasonable roadmap to achieve broader purpose and function.

It is possible that almost any tech that is used for gaming platforms has a potential game->enterprise roadmap in place. There are tons of examples of video game breakthroughs just becoming general purpose breakthroughs in the technology space. My favorite is that of NVIDIA, which started developing their chips for gaming purposes and now have revolutionized the AI / Machine Learning industry as a result. This game<>enterprise corollary is likely explained because gaming, at it’s core components, is a simulation of life (not literally, but emotionally and logically), just as most software is a form of simulation as well - simulating tracking something on a notepad, simulating solving a math problem, simulating analyzing big streams of data.

Does it matter if there aren’t any enterprise use cases for XR technologies?

Interestingly enough, Oculus for Business, the business unit within Meta that exclusively sells Quests to commercial customers has been mothballed. The reason being that Meta is trying to create a product that can’t be decoupled from work and play - think work phone and personal phone dichotomy. There are a lot of companies that still require employees to have two separate phones (or rather, employees who require themselves to have two separate devices), but most just compile work and play into one device. As of 2016, it is estimated that 26% of companies provide a work phone - a number that has likely come down in recent years. Meta is trying to do the same with its XR headsets - work and play all bundled into one headset.

This could potentially be important for the XR community because adoption can start on the consumer side, but eventually that will bleed over into the enterprise world as well. Most enterprise software solutions only switched over to mobile form-factors after it became such a clear demand from users. This email client needs to work as well on a laptop as it does on mobile because that’s where the user is. So if this consumer adoption occurs, there is a ton of potential for VR to be easier to break into the enterprise space. Microsoft will already have a VR chat system, might as well create a training environment as well.

Realistically, however, it’s still important to understand the enterprise roadmap because that will accelerate XR adoption. It’s worth considering the Not Even Wrong framework for tech toys. There is a pretty clear product roadmap for XR to cross over the enterprise chasm. Are the existing problems that laptop, desktop, and mobile software just can’t solve, but could be improved in a virtual environment? Yes - training, medical assistance, occupational therapy, and many others. Basically anything that requires real world, hands-on experience, can be simulated in a VR or AR setting and generate positive returns. Sure, there will be some things it’s better for than others, but it’s not just about pure efficacy, sometimes it’s about convenience or availability. When I FaceTimed my parents in April 2020, it wasn’t as good of conversation as if it had been in person, but due to COVID, it was a decent facsimile. When you are training a new warehouse worker on a specific job via VR headset, it’s probably not as good as having a world-class trainer do it in-person, but that doesn’t necessarily scale. Nothing beats in-cockpit experience when learning how to fly an F-35 (I can’t stop thinking about TopGun:Maverick), but VR training doesn’t cost $122 million and can provide a good start. Do we need to have virtual meetings in AR? Maybe, maybe not - Zoom seems to be doing just fine for now. If there’s enough adoption, it could be totally possible, but it’s more likely that we need solutions that simulate situations where someone actually uses their hands, which we still have a lot of in this world that are untouched by software.

And the technology to enable solutions like this exists today. Breakthroughs are happening every day in machine vision. The unity game engine would blow you away. I already mentioned NVIDIA and what it’s chips can do. So at this point, for VR/AR, it becomes all about adoption. And while it’s great that Meta has gone all in on the metaverse, it would be nice if there was a little competition too.

Good news: there is. Apple recently showed it’s VR headset to its board and the rumor mill has been swirling for years/months about it’s XR ambitions. Does anybody have any good stats on Apple driving consumer adoption in a marketplace for new tech products?

Oh yeah.

So when you start looking at long-term projections for XR products, the vision starts to become a little clearer. And as those hardware products become more commonplace, more software will come into the fold as well. There are currently ~50 million VR users in the United States today. As more come online, and more appreciation for the technology occurs, the bigger the demand will be for more XR solutions. There are a lot of startups trying to create the next great enterprise SaaS solution for XR, and while I am not sure if the long-term winner has started yet, it doesn’t seem like this tech is just a toy.

![r/dataisbeautiful - [OC] AirPods Revenue vs. Top Tech Companies r/dataisbeautiful - [OC] AirPods Revenue vs. Top Tech Companies](https://substackcdn.com/image/fetch/$s_!4TnV!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fef5ca983-44db-42db-80cb-26c262889f53_960x960.png)