Disclaimer: Newsletter and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice. Opinions contained within this letter are my own and not those of my employer.

In the venture markets, the last twelve months have been marked by some return to normalcy and stabilization after the runup in valuations, deal sizes, and general insanity seen by the post-COVID market frothiness. Frothy seems to be an understatement for what occurred in 2021, since it was, after all, a bubble. But then again, that is probably the origin of the term frothy - froth is a collection of small bubbles.

There has certainly been some turmoil over the last 12 months, but overall, it’s a more stable market. In order to make sense of the industry’s current state, I have broken down three key themes:

Deal activity has plateaued, but it is still above pre-COVID levels. This has resulted in a more investor-friendly market. However, the bar was pretty low considering how out of control things had been.

The exit market is still dormant. Deals just aren’t getting done. We are starting to see inklings of activity and whispers of improvement, but it’s still pretty early in that journey.

As is always the case in venture capital - the solution to dilution is execution.

As seen in the chart above, VC Deal activity has relatively leveled off. While it sometimes feels like the world has stopped spinning on it’s axis when compared to early 2022 and all of 2021, it’s still relatively on pace / above pace for 2019 and prior. While actual deal value has effectively remained flat over the last four quarters, count of deals continues to tick down. This likely indicates a flight to quality. It could even theoretically be a sign of more folks investing at the seed level, relative to prior years, as that is viewed as a relative safe haven to market fluctuations - however, that is a tenuous argument.

MOST INVESTOR FRIENDLY ENVIRONMENT IN A DECADE

Pitchbook runs an index every quarter tracking deal making and investor friendliness. The last four quarters have seen a marked increase in investor friendliness. This has manifested in a handful of ways, including improved valuations, smaller round sizes, and friendlier terms overall. As capital is harder to come by, investors have gained leverage over startups.

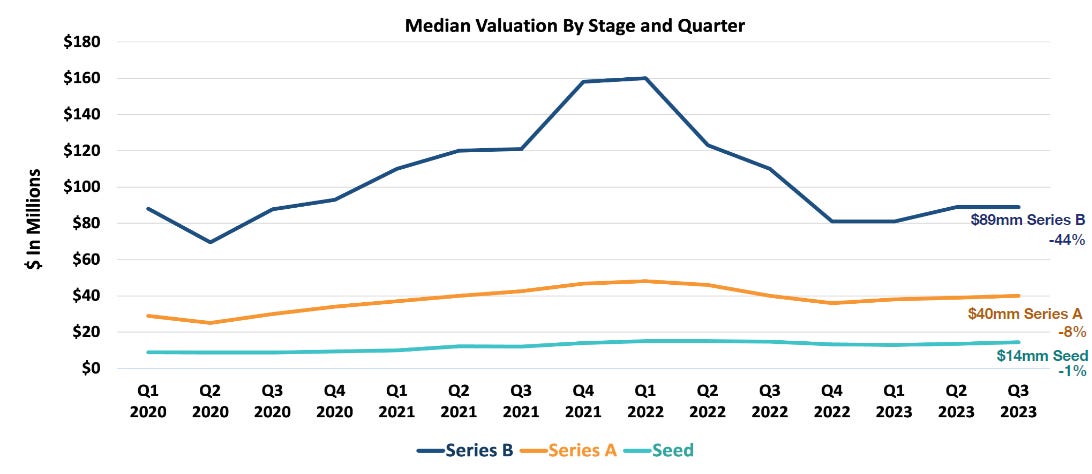

Valuations for early stage rounds have flattened out over the last four quarters. Seed and Series A are relatively flat, even when in comparison to peak levels. Seed is one of the most resilient asset classes in venture, if not all of private equity, and is heavily insulated from market fluctuations. Which makes sense, as seed valuations are inherently driven from investing in effectively un-formed (pre-product-market fit) companies, with very little data on which to derive valuations. Investors and founders understand at this stage that the risk is high and to try to extract too much valuation premium here on either side can be counterproductive.

Series B, on the other hand, has been hit pretty hard, nearly having been cut in half. Series B rounds used to sometimes be seen as the penultimate round of financing, meaning a company raising at that stage frequently was gearing up for an exit before one more cash infusion. This has changed with the proliferation of later stage capital. While it is unclear if this has a correlation on the whipsaw in this stage’s valuation or round size (see below), it’s hard to ignore.

Everything you could say for valuation is true for round sizes as well for Early Stage rounds. These are heavily correlated because of the nature of ownership targets in venture capital.

When we look at later stage venture capital: ouch. Frankly, you could look at the chart above and conclude that bottom is in and it’s all going up from here. However, the inversion of some of those lines in the last few quarters would lead me to believe that the market is still trying to figure itself out. I am not saying that I expect it to go down further, however, I do think there is some realignment around what an actual later stage venture capital round is like - who uses it, when they use it, how frequently these rounds get deployed, and who is deploying the capital.

One final point surrounding how investor friendly this market is is the time it is taking to raise capital. It is now, on average, taking startups eight extra months to raise the next round of financing than it was during the peak of the market. This means that companies are being held to a higher standard, more folks are trying to avoid going to market due to valuation concerns, and more companies are placing an emphasis on reaching cash-flow breakeven, or at least default investable. David Sachs has a great twitter thread on what exactly that means, but I do think this is how the market has started to course-correct since late 2021, and is still going on today.

You can see this trend towards an emphasis on profitability in the public markets as well. Of course, the cynical investor might say “profitability is all that matters, always has been, and the last two decades of an emphasis on growth are an aberration”. [That person sounds fun at parties]. But also, the market does not necessarily reflect that. I would point you to the substack of Jamin Ball, who recently talked about how growth-adjusted multiples are trading recently.

There is a lot in there about what’s happening to public cloud stocks, but the punchline is pretty simple: if you are growing at an acceptable rate (which is up for some debate these days, but let’s say >25% YoY) you can still garner a strong multiple, especially if you have a decent FCF profile (again, debatable what that is, but at least positive). However, if your growth slows down at all and your FCF profile doesn’t improve (Jamin uses an excellent case study on Confluent to get his point across), then you get hammered, and the floor for your valuation basically doesn’t exist.

What does this mean for startups? Well the basic truth is that this trend in the public markets has effectively been happening for the past 12 months. So in order to be strong candidate for investment, even at the Seed / Series A stage, you have to demonstrate capital efficient growth. It’s not just about hitting big topline trends, but you have to do it in a way that is a scalable, repeatable market. That does not mean that you need to be cash flow breakeven, but you need to have a solid burn multiple and a general ability to grow without capital infusions.

STARTUP EXITS REMAIN ELUSIVE

When someone asks me how the startup market is today, this is always the thing that gets the most follow-up questions. "When will the IPO market open back up?” “Are bigcos being acquisitive?” “What’s the liquidity market like right now?” etc. etc.

It’s extremely hard to forecast out what’s going to happen. And while I am not one who likes to call a “bottom” in any type of market, because that’s a silly exercise, I think there is a pretty decent case to be made that the startup exit environment is currently at a bottom, and has been for some time.

Deals just aren’t being done. Period. Of course, 2021 was an outlier of a year, but even compared to pre-COVID levels, the data is pretty stark. The IPO window is effectively shut and big tech acquisitions have slowed to a molasses-like pace. There’s not really a lot of data here to share because you need activity to have data.

But, there are some glimmers of hope. First, the IPO window, while not open, does have some cracks in its facade. Klaviyo, InstaCart, and Arm all went public in Q3, within approximately a couple of weeks of each other. These three are notable because they are all venture-backed tech companies, and they were effectively the first three tech IPOs in over 18 months.

While these stocks are not really performing how you would expect an IPO to perform after being in the market for only a couple of weeks, they are at least showing some signs of resilience. Klaviyo in particular has performed adequately, and, wouldn’t you know it, it’s a profitable enterprise. Importantly however, these IPOs were able to get done at all - which would not have happened 12 months ago. There is some modicum of investor appetite out there.

Another sign of market resilience would be the activity surrounding take privates, or PE-backed acquisitions of previously public companies. Half of the largest PE deals done in 2023 were tech take-privates, which is well above historical standards. 57% of take privates in the first half of the year were backed by private equity firms, which is more than double their share in the past three years. Some of these were for some big price tags as well, well north of $5 billion in purchase price.

This matters because, historically, PE as an asset class is one of the more price sensitive buyers in any market, especially when considering the tech ecosystem. If even PE is starting to feel bullish on some tech valuations, especially over the medium term, then there are signs that it’s a good time to buy. Take privates actually share some similar timelines to Series A & B investors and similar paths to exit.

One final sign of resilience is the fact that hypergrowth is all around us. You have likely seen the chart below on OpenAI reaching 100M users in under 2 months, lapping some of the greatest hyperscalers of this last century. The inference here might be that OpenAI is going to dominate the ecosystem and leave a trail of bodies in it’s wake. Or that AI is the only bright spot in the VC asset class. However, I think those are the wrong lessons to take away from this case study. OpenAI is able to achieve such astounding growth with effectively no network effects and very little marketing. It did so because it is able to take advantage of the core principal of venture - distribution and scale are great when you combine software with the internet. If you build a great product that people want, and sell it on the internet, you can grow quickly. ChatGPT is not the first, nor will it be the last.

THE SOLUTION TO DILUTION IS EXECUTION

The quote above, which I learned from one of my favorite investing minds in the midwest, is true now, was true in the past, and will forever be true in the future. Many people like to think of venture as an asset class that you can put in a box and understand on a macro scale, like mortgage lending or consumer credit or treasury bonds. But the reality is that great venture capital investments are made during all kinds of markets. Bad ones are too. What matters is if a strong company can execute on it’s vision or not. Do you have something people want? Can it scale? Then what are you waiting for?