Disclaimer: Newsletter and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice. Opinions contained within this letter are my own and not those of my employer.

We all probably know somebody who adopted a pet in the middle of the pandemic. Especially after the first month or so rolled by and it appeared that we really weren’t going to get out of our houses any time soon, it seemed like everybody I knew was looking to adopt a dog or cat. My wife and I even discussed the idea of getting a hypoallergenic pup to keep us company. We never pulled the trigger (bought a house instead), but plenty of our peers did anyway.

And we couldn’t help notice the anecdotal evidence building around us that the pet industry seemed to be entering a new boom-time. Every time we went on a walk through the park, more and more dogs appeared in our path. The pet groomer around the corner from our house was always busy and had a line out the door, even with COVID restrictions in place. It seemed like every pet had a social media presence and that every social media platform increased its abundance of pets.

On top of all the confirmation bias we were experiencing, some data started backing it up. Stories about pounds that didn’t have any dogs left to adopt filled feeds. News about increases in pet spending reaching its peak abound. During the most recent holiday season, the anticipation for pet spending was incredibly high.

And even before the pandemic, it appeared as though all of the demographic trends were pointing in the right direction. Millennials are spending more on their pets than previous generations. A higher share of Millennials actually own pets, and more of them have multiple pets than ever before. Dogs and cats are viewed as ways for Millennials to prep for potential parenthood, an act they are delaying more and more. But it’s not just Millennials who are going gangbusters at the pet store, even Boomers are spending more on their pets than ever before and owning pets at a higher clip than prior trends would suggest.

As an investor, I feel it is my duty to pay attention to economic trends, even if I am late to them. Thus, I wanted to spend some time better understanding the Pet Sector and the impact of these current trends. Of course, like most folks late-to-the-party, I was drawn to this trend because of personal experience, and not because of some outbound macro-thesis I had developed. As a result, I was not the first person to think that the pet industry would be ripe for investment. However, that doesn’t mean there isn’t still room to run.

As it turns out the Pet Sector is incredibly hot. See the tweet below for some anecdotal evidence:

The punchline? That seller wanted 11.5x - 15.0x EBITDA!

The acquisition multiples are at all-time highs, and the investor appetite for pet-adjacent businesses has skyrocketed. As I have been talking to bankers, operators, and investors in this space, I have come to the realization that winning here would be very competitive. Of course, sometimes the most competitive races are also the most rewarding.

I am still very much in the market for the right pet-industry company, but I still have a lot of homework to do to wrap my head around the space. As a part of my effort to further grasp the sector, I have started to analyze one of the hottest public names in the space: Chewy.

$CHWY Analysis

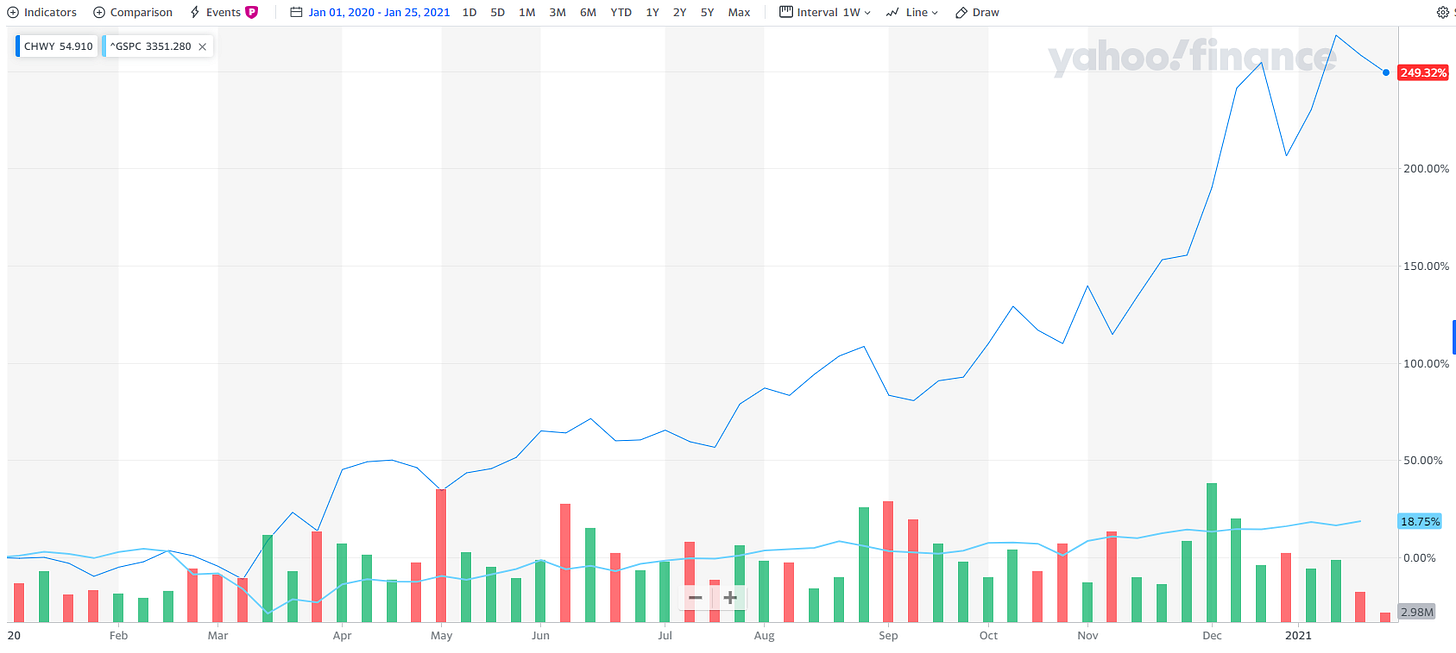

If you have paid any attention to the stock market over the past two years, you have probably spent some time thinking about Chewy. It is the current title-holder for online distribution of pet-supplies in the USA. The Company focuses on dogs, cats, birds, fish, small pets, horses, and even reptiles. It is, to borrow from Amazon, the everything store for your pets. It made $4.8 billion in net sales in 2019, and is well on track to crush that number in 2020, as of its most recently available public filing.

There is no doubt that the Company’s growth story has been impressive. The below chart is from its 2019 S-1:

The Company is of a specific post-2010 brand of e-tailer that focuses on being broadly specialized to win in a growing market. Of course, you can purchase pet food, toys, etc. on Amazon or Walmart.com, but you can count on Chewy to have a high-quality shopping and return experience. At least, that’s the current story Chewy’s management team is trying to sell to investors. If you are going to spend so much money on Fido or Mittens, you better make sure that it is done with folks who actually know what you are looking for.

The Company does not have any storefronts, and is effectively a logistics and marketing machine, more than anything. But when reviewing the Company, what seems to really stick out is their customer-service capabilities. One former board member bragged when Chewy went public that the average length of a customer-service call, not including wait times, is ~2 hours. That is not because the customer service experience is so poor and inconclusive, but because the Chewy customer service team is focused on helping pet-owners with all sorts of pet problems, not just dealing with delivery of product. As a result, they have tremendous customer loyalty. (I will say that despite that being a stat Chewy seems proud to share, it is still dubious).

Customer service can be expensive, however. SG&A expenses as a whole represent approximately 20% of total revenue, most of which has been led by increased fulfillment center costs and customer service center costs. From their most recent 10Q:

Selling, general and administrative expenses for the thirteen weeks ended November 1, 2020 increased by $93.8 million, or 36.3%, to $352.3 million compared to $258.5 million in the thirteen weeks ended November 3, 2019. This increase was primarily due to an increase of $78.4 million in fulfillment costs largely attributable to increased investments to support overall growth of our business including the opening of new fulfillment centers in Archbald, Pennsylvania and Salisbury, North Carolina, a limited catalog fulfillment center in Kansas City, Missouri, a customer service center in Dallas, Texas, growth of fulfillment and customer service headcount, and temporary incentive wages and bonuses as well as incremental cleaning and sanitation spend attributable to COVID-19.

That’s four new facilities opened in Q3 2020 alone, in the middle of a pandemic. As the Company continues to grow, I imagine that SG&A number will need to rise at a similar pace as well. If you can’t beat Amazon on price (they can’t), you need to beat them with customer service and experience (they can).

But it looks like that investment in customer service is paying off. The net sales per active customer (a KPI Chewy closely monitors) has gone up every quarter since IPO, from $314 in 2018, to $363 in the most recent fiscal quarter. This is evidence that the Company’s customers spending patterns are only increasing, likely due to improved customer-dollar retention.

On the flip side, the Company is spending more money per acquired customer in 2020 than it did in 2017, from $68 three years ago to $148 of marketing expense per new customer acquired. According to some sources, the average acquisitions costs in the home goods industry across all marketing channels were $22 / customer. That may seem like a big difference, but keep in mind that represents all marketing channels, whereas Chewy is only playing in some of the more expensive and competitive marketing channels, like social and paid search. It is possible that Chewy is performing in line with its competitors where it counts - it’s too tough to tell right now.

Chewy also has a blended customer churn rate of ~33%. This is above comparable e-tailers average churn rate of 22%. While this is not great, it has been moving in a positive direction and shows some forward momentum for the Company. Once a customer is retained in year two, the churn rate drops to 10%. As time goes on, churn for each customer cohort gets lower and lower. So while they are spending a lot of money to acquire customers, when a customer actually sticks around, they become very lucrative.

Of course, no conversation about an e-tailer’s performance in 2020 is worth having if you don’t discuss the acceleration of online spending due to COVID. And there is no doubt that Chewy has experienced some tailwinds due to everyone being less able/willing to do their shopping in person and more likely to shop online. As this trend accelerates, and Chewy gets larger in general, their gross margin is set to improve. They have experienced improved margin as a result of supply chain efficiencies that are becoming b-school case-study examples of economies of scale.

However, that doesn’t change the fact that they are unprofitable. In the first three quarters of 2020, the Company lost $113 million, which, when compared to the same period prior year, is an improvement - the Company lost $191 million in the first three quarters of 2019.

Chewy’s cash flow statement does paint a slightly better picture. They do have positive operating cash flows and when it comes to the overall cash picture are most heavily weighed down by change in inventories (to be expected with a retailer growing like bananas) and capex. Of course, we want a company like this to reinvest it’s cash flows into savvy investments. And if they are able to pay for it using their well-priced security offerings, more power to them. However, that doesn’t change the fact that they are living on a razor’s edge, to a certain extent. Growth does require risk, and thus the Chewy management team seems fine with that and the market is rewarding them.

One notable piece of their financials is their use of share-based compensation. A trademark tool for most high growth tech companies, Chewy appears to be using it to attract their talent and retain employees to great effect. If you are going to go through a period of hyper-growth and execute their supply-chain effectively, you need good people. And good people want to get paid and incentivized in all the right ways. Of course, this is not a cash expense, but I do think that most companies pay for it eventually. But if you get to a point where your employees are not interested in stock-award payment, that probably means you have bigger problems to worry about.

I do think the Company could turn on profitability at almost any moment, but they are refusing to in order to continue to grow, grow, grow. And if you are in this market, with these conditions, why would you do anything otherwise? Growth is rewarded above all else in the current equity markets - play that game at your own risk, of course, but Chewy appears to be playing it well.

In the M&A space, average Pet EBITDA multiples can range from 8.7x to 19.4x, as of the end of 2020. And it seems like those numbers are only going higher. The overall Pet Sector has performed much better than the rest of the market. While you might think that the Pet Sector index has outperformed simply because of Chewy, it’s not the only high growth company in the space. So while some think it’s being priced like a tech stock, that’s wrong. Pet growth stocks are hot too.

In conclusion, it’s hard to take too much away from Chewy’s performance over the past several years other than that it is riding a tremendous wave of positive industry tailwinds and accessible investment capital to spurn future growth. The Pet Sector continue to stay hot because of aforementioned trends and that doesn’t appear to be going anywhere.

Friday Links

Two Worlds: So Much Prosperity, So Much Skepticism

I love pretty much everything my guy Morgan Housel writes. He might be the current title-holder for best writer about current economic machinations. His take here (about K-Shaped economies, which I talked about a few weeks ago), is very cogent. One of his main points is that while a lot of people are wondering what will happen once COVID is gone, we should more pay attention to all the things that have already happened, because it’s been a lot.

Speaking of GOATS, the most recent Acquired podcast about Bitcoin is easily the best thing I have consumed about cryptocurrency. If you are in the world of finance at all, you should give this (3-hour!) behemoth a listen to better wrap your head around Bitcoin and the state of currency today. This is either a massive shift in the status quo, or at the very least, an interesting case study. And while some of their basic econ discussion is rudimentary, they do such a good job that you can at least follow along.