One Does Not Simply IPO Palantir

The Most Secretive Firm in Silicon Valley Knows Your Secrets

Peter Thiel is an interesting dude. He is one of the members of the PayPal Mafia and he has built a veritable Silicon Valley fiefdom, investing and starting companies all over the map. It seems as though he has his hands is half of everything that goes on in the Bay Area tech scene. He’s wildly controversial - idolized by some, and scorned by others. Depending on who you talk to, he is everything good and bad about this country, and sometimes both.

He’s also a pretty big nerd. How do I know that? Other than his storied career as king of tech nerds in SV - he names everything after a character, place, or thing from Lord of the Rings. And look, I have nothing against that move - this blog is literally named after an incredibly niche scene from Star Wars. Hard to argue that’s not a nerd move either. But I love Thiel’s commitment to a theme. And what’s even more impressive, most of those names actually make some sense.

One such logical name comes from one of his most successful ventures - Palantir Technologies. If you are not familiar with what a palantir is in LotR, don’t feel alone. I had no idea either until I rewatched the Two Towers a couple of weeks ago. And even then, I had to do some light googling to figure out exactly what they do. Essentially, they are crystal orbs that allow the user to see events in the past, present, or future all over Middle-Earth.

For a fantasy novel, a palantir is a pretty impressive piece of technology. Which is part of the reason why naming his big data software company after one made so much sense for Thiel. For those of you not familiar with what Palantir Technologies (the company, not the LotR artefact) does, they are a software company that started out selling to government entities in the intelligence community. They built products that intelligence organizations could use to organize and better manage their data. After a while, Palantir started selling to commercial enterprises as well, in order to expand their TAM and broaden their scope. And after 17 years of selling their crystal ball software, they recently decided to file to go public.

The Company has several software solutions. They effectively operate as a central operating system for their various customers. The first product, Gotham is targeted at government / intelligence / pseudo-military organizations. The Company’s S-1 claims that analysts at intelligence agencies, prior to Gotham rolling around, were mapping insurgents in conflict areas by hand. But with Gotham, those same analysts are able to find needles in the proverbial data haystacks that make up these intelligence organizations. See below for a screenshot of one of Gotham’s features - Graph.

Gotham has several features: Graph, Gaia, Dossier, Stencil, Video, Table, Ava, Forward and Mobile. Most of these are some data interpretation or visualization module. Graph is the software equivalent of one of those cork-and-string link charts. Gaia is a highly-interactive map-app for planning and executing operations. Dossier is Google Docs but for spies. Stencil is a wiki, but for spies. Video is YouTube (or TikTok), but for spies. Table is excel, but for spies (but probably shittier). Ava is the AI that interacts with all of these tools. Overall, it’s a pretty slick feature suite.

What intelligence analysts used to look like prior to Gotham

The other Palantir product is called Foundry - in theory, it is Gotham, but for large corporate enterprises. But it’s a little bit more than that, as it is more focused on integrating different datasets to make them more actionable. Foundry acts as a data pipeline with a built-in user-interface to make connecting different data sets more readily accessible and less complicated.

Foundry has the following features: Monocle, Contour, Object Explorer, Fusion, Workshop, Vertex, Code Authoring, Quiver, AI/ML, Code Workbooks, and Reports. Monocle allows for users to track data - where it’s going and where it’s come from. Contour, Quiver and Object Explorer are data visualization tools. Fusion is a spreadsheet tool for the user’s underlying data. Workshop is a no-code tool for building applications on the back of user’s data. Vertex is a supply chain management visualization tool. Code Workbooks and Code Authoring are devops tools and AI/ML is a model builder.

It’s safe to say that Palantir is not messing around when it comes to its product/feature set. The Company is not trying to build a point solution, or a handy hack that can solve a problem or two - Palantir is trying to be the central heartbeat for its clients. In its S-1, the Company uses the phrase “Central Operating System” 21 separate times.

What’s also clear from the S-1 is that Palantir isn’t just trying to replace existing operating systems - it is trying to rip the hearts out of its competitors. I normally don’t recommend reading any parts of an S-1 unless you are considering investing in a company or its your job, but some of the diatribes put in this one are worth the price of admission - especially when it comes to talking about the state of software. A few of the highlights:

Other software companies have incorrectly assumed that the future will look like the past, forming their strategies based on assumptions about a world that no longer exists. A focus on targeted analytical tools and optimizing specific functions within complex organizations is insufficient. We believe that software must connect the entire enterprise. Our most critical institutions cannot wait a year or longer for a promised application or bespoke solution to be developed. Those options are often obsolete before they are even delivered.

Most software makes companies more similar, not different. Packaged software tends to be designed to meet standardized needs. But commoditized solutions are only sufficient when keeping up with the market — that is, beta — is the goal. When it is time to generate differentiated value — that is, alpha — we believe that typical packaged software falls short. A company seeking to capitalize on its unique resources or to uncover a need unmet by its competitors requires more than software that simply conforms to well-defined best practices.

However, if you read further along in the S-1, the Company clearly states that it is not trying to replace existing systems, but just augment them. The Company also talks about the importance of building a company with first principles, what those first principles are, how their team is different from everybody else, and how they have “chosen sides”. This is clearly a Company that has something it wants to say and isn’t just skating by on typical corporate-speak. What’s so ironic is that it’s also incredibly secretive.

Palantir does not disclose any of its customers, other than in broad strokes about the US government. But, the nature of its work is secretive. It boasts that one of its core competencies is government-level security and protection on its software products. The Company is secretive because it has to be, but also, I suspect, because that clandestine nature helps brand the organization the way its clients want it to be. If you are going to manage the data of an intelligence agency, you better not be beating the drum for open-source software products or something like that. Playing things close the the chest for Palantir is smart, but it’s also good PR.

That’s part of what makes this S-1 so interesting - one of Silicon Valley’s most elite, most secretive firms is letting us take a peak behind the curtain and check things out. In some ways, it’s not at all what you would expect. The Company openly takes shots at Silicon Valley and it’s “engineering elite”. It basically says that the way enterprise software is currently being built is bunk. Palantir has “chosen sides” - it is fighting in the trenches with the forces of good (aka America and her allies) - you don’t see a lot of SV firms doing that these days. It sued one of its current customers and won, which actually should open the doors up for more business in the future. These are all things I would be pretty surprised to see happen if Google, Facebook, or some other big SV giant was behind them.

But there are also ways that Palantir is similar to some of it’s SV compatriots. (I should clear up that Palantir is actually moving to Denver, but up until this point, it was still very much a SV company.) The Company was backed by several prominent investors and raised gobs of money in the process. It has a massive valuation pre-IPO. It going public via direct listing, which, may sound counter-intuitive, but that’s very in-vogue in the Valley these days. And last, but certainly not least, it is going public while losing hundreds of millions of dollars - “We may not be able to sustain our revenue growth rate in the future”.

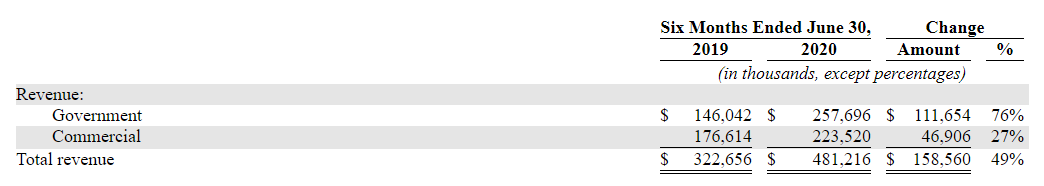

Although, if you look at the Company’s financial position, it’s not exactly one that screams out for help. As the Company is filing a direct listing, it does not need to give more than financial data from the prior two fiscal year-ends. But even so, it’s year-over-year growth rate of 24.7% is rather impressive, especially for a company making nearly $742 million in top line revenue. This is especially impressive when you consider how long the sales cycle is for clients of this nature. And the Company isn’t slowing down in 2020 so far, as it has made $481 million YTD through six-months, an annualized revenue figure of $962 million. Although it should be noted that the Company reportedly was close to reaching sales of $1 billion back in 2015, during it’s most recent publicly announced valuation ($20 billion on a 20.0x revenue multiple). I am assuming that that was more an estimate of the Company’s contract values max upside, but still, being at less than $1 billion is somewhat surprising considering the hoopla surrounding this Company.

On top of that, the Company has had a lot of success pivoting some of it’s product to be more commercial facing. For a company with a narrative so interlinked with government contracts, their commercial customers make up a pretty decent chunk of the business.

No matter how you slice it, the revenue figure is still impressive. But that doesn’t change the fact that the Company is still unprofitable. While the Company has solid Gross margins (between 67% and 72%), it is underwater from operating expenses and net unprofitable. The Company has started to turn around it’s profitably from 2018 to this year, but it still has a while to go. On the other hand, a pretty significant portion of the Company’s operating losses are attributable to non-cash expenses - stock-based compensation. If you were to factor out those expenses, the Company would have made a modest $17 million profit in the first half of 2020. Of course, you can’t do that, but it’s worth noting.

I am not totally sure why Palantir is spending so much on stock-based compensation, especially considering its rocky relationship with equity compensation in the past. There have been stories through the years of employees not being able to sell their shares, and stock-based compensation being limited due to morale issues on account of valuation write-downs. However, that doesn’t seem to be the case any longer - Palantir has increased stock-based comp in order to explicitly cut cash-expenses and “ensure employees can have access to equity ahead of an IPO”. That plan has so far worked, but we will see how long that should last - those employees will need to continue to be paid adequately post-public filing. Either way, the Company is hemorrhaging cash.

However, a big, SV-backed, real software company that’s nearing $1 billion in revenue has rarely scared the market, especially in these markets. Although it would be easy to say that the market is extremely frothy and all they care about is growth (and that’s potentially true), I think it’s also worth considering some of the company’s underlying stats.

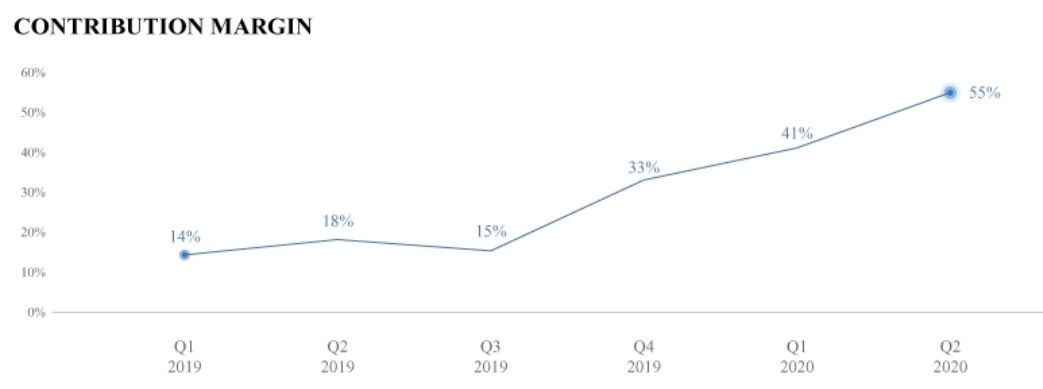

The Company currently has 125 customers across a variety of industries. The average contract value for these clients is $5.6 million - an absolutely staggering number, for any kind of SaaS product. The average length of a customer contract is 3.5 years, which seems to be in line with what the market expected. And, what’s maybe even more important about these customers, is that the contribution margin on the entire set is generally trending in a positive direction. From the S-1:

This figure is a great leading indicator for how profitable the business can be in the long term. There are probably a lot of reasons why contribution margin is expanding, but I think a big reason is the Company’s improved ability to land-and-expand its current customer base. In the S-1, they talk about their Acquire, Expand, and Scale segments of customers. While they don’t specifically break these segments out by year or anything, it is clear that the strategy is to take a loss while piloting their products, and then expand revenue in a massive way once those pilots are successful. This is a fairly conventional sales process for a SaaS business, and it appears that Palantir is executing upon it very well. In 2019, the Company generated a total of $742.6 million in revenue, of which $0.6 million came from customers in the Acquire phase, $176.3 million came from customers in the Expand phase, and $565.7 million came from customers in the Scale phase. As customers move up that scale, the contribution margin only gets better and better, from negative, to nearly 87% for some top customers.

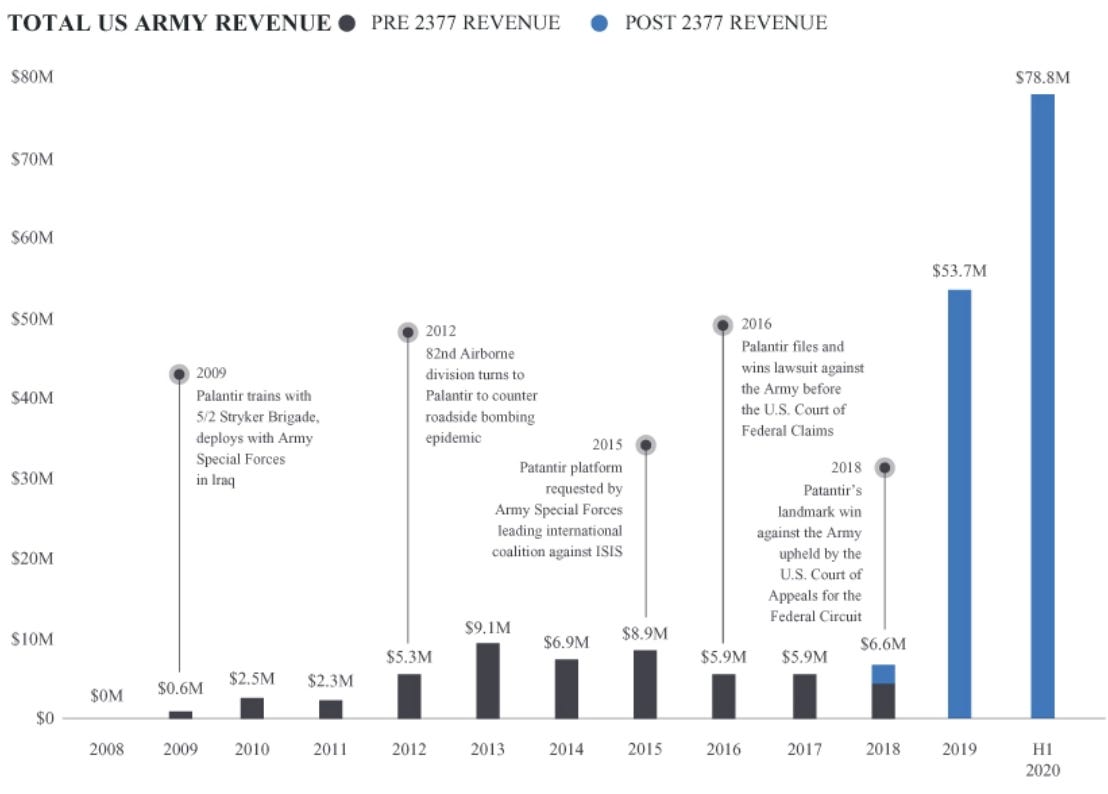

One example of the Company’s ability to expand margin and increase sales revenue by client is the US Army. I alluded to it earlier in this post, but Palantir did sue the US Army in order to allow for a more fair bidding process on software projects. That suit was settled in Palantir’s favor in 2016, and it appears be paying dividends.

If Palantir can continue to sink it’s teeth into big government organizations like this, they have a long way to run.

One other metric for Palantir that is particularly compelling is how much cash it has on hand: ~$1.47 billion for June 30, 2020. While the Company is clearly burning through a lot of cash, that’s still a pretty big reserve to last them for a while. What’s more, the Company is filing to go public via direct listing, meaning it’s getting into the public markets without raising any capital.

As I have said before, direct listings are very much in vogue among Silicon Valley’s elite right now. And if you are trying to provide a return to investors but don’t need to raise capital, direct listings can appear to be attractive. And certainly, the number one reason for Palantir to go public is for them to provide liquidity to its investors. The Company has raised nearly $2.5 billion since founding, so there are a lot of folks looking for their piece of the pie - not to mention that this is a 17-year-old company, way past the average age of exit for a startup.

But there is one thing that might make you scratch your head when it comes to this offering - Palantir’s secrecy. They are a notoriously secretive organization and going public could open up some of those secrets for the broader public to know. However, it should be noted that the Company is clearly trying to make a bigger pivot into enterprise clients, and being public might make it easier to sell into those organizations. Palantir’s sales folks will spend less time educating clients on who they actually are, and more time on finding a good fit/sale. That might not be the primary reason for listing, but I would guess it is definitely playing a factor.

Who knows how this liquidity event will turn out, but one things for sure: for once, everyone will be watching Palantir, and not the other way around.

Friday Links

SEC Updates Accredited Investor Status

If you are unfamiliar with what it takes to be an accredited investor, up until this point in time, it was entirely based on your earning power or your net worth. That meant that you could only make private investments if you were “rich”. I know plenty of smart investors who don’t meet that criteria and plenty of dumb rich people who do. Now, the SEC is updating it’s policy to expand that definition of accredited investor and I think that’s going to be a huge boon for wealth generation in this country.

Morgan Housel with some great work from a few weeks ago. Good reminder that in order to be great, you have to keep moving forward. And you have to make sure you understand what “be great” really means.

Meme of the Week: