If you didn’t catch my letter from last week, this current one is a continuation of those same ideas. I recommend you check it out here in order for this letter to make more sense. If you don’t have that kind of time, but have read two sentences into this disclaimer and feel invested enough that you won’t quit on this letter, the TLDR from last week is thus: I worked in Venture capital for 2+ years and learned a couple of things. I still have a lot to learn about investing, but I wanted to share some of the big ideas I learned from my time as a VC. And I am moving to Cincinnati to work in Private Equity.

Let’s dive right into it:

High-Growth Venture-Backed Tech Isn’t the Only Way To Make Money

Of course, this lesson is a little obvious, but there are some layers to it, so let me unpack a bit.

It feels like everyone in America over the past two decades who made a fortune made their money either starting and scaling technology companies, or by funding people who did (and a lot of them did both). While that certainly feels true it’s not 100% accurate. There have been plenty of folks that have made fortunes doing things other than starting a tech company. This lesson was pretty easy to learn and didn’t require me getting into Venture Capital to realize.

However, one misconception I had, that I think a lot of folks have, is that if you are going to start a tech company, the only way to do it is through venture capital. A tech company either reaches the highest of highs (i.e. see the tech IPO market for 2020), or crashes and burns (i.e. NASDAQ 2002) - there is no in between. Software requires you to swing for the fences and any effort short of that would be futile. Any middle market software or tech company was just a languishing outfit, looking to get swallowed up by a bigger player. And if you were a tech company looking to achieve a “middling” outcome, there would be nowhere for you to raise capital or reach an exit.

None of those things, it turns out, are true. We read and hear about the high-flyers of the tech world because they make for the most interesting stories that appeal to an almost universal human narrative: is this tech company going to be the next big thing, or is it little Icarus, flying to close to the Sun? What’s more: Venture Capital is designed to be used for tech companies that are swinging for the fences. And while it’s hard to hear about private company milestones that actually matter ($5mm in ARR, 100 employees, net profitability, etc.), it is really easy to hear about fundraising. So the only way that we celebrate these private tech companies is through fundraising announcements. But anybody who works in finance knows that a fundraise is the start of something, not a crowning achievement. So it seems like the only tech companies we hear about are the ones raising big dollars and trying to land on Mars (metaphorically and literally).

But the reality is that most tech companies are not that way. In fact, during my time at Rev1, I was blown away by the amount of middle-market tech companies that had solid, cash-flow positive businesses and were making a (small) fortune for their proprietors. But the thing is, VC’s could hardly ever invest in these kinds of companies - if you are familiar with Venture Capital at all, you know that the types of returns VC’s are looking for don’t really match up with these kinds of companies. So while I became especially aware that these mid-range software companies exist, there wasn’t anything I could do to help or invest in them.

And while that may sound like the smallest, least significant sob story in the history of sob stories, the reality is that these kinds of companies face their own capital gap - the amount of PE shops buying up lower-middle market businesses is pretty low. Of course, that’s not an issue for the versions of these firms that are already going concerns as they don’t need financing to continue to make a killing. However, for the ones that are just getting started, there is a lack of financing options. There are some folks who are starting to move into that space, like Earnest Capital, Indie VC, Lighter Capital, just to name a few. But overall, this space continues to be undercapitalized. However, stellar businesses are being built without traditional Venture Capital anyway - anytime something occurs despite a lack of structural support, that means there is probably huge opportunity for whoever starts building that structural support. My friend Erik Berg (@abergseyeview) refers to this phenomenon as the Cantilever Effect. (Ask him about it sometime).

On top of that, the middle market space for companies that are already profitable and reached relative growth maturity is pretty massive as well. And while there certainly are more investors who are looking to snap up healthy, growing middle market software companies, the entire industry is not at all saturated. There is competition, but plenty of niches still waiting to filled. It’s easier said than done of course - the metrics and things you look for in a successful software company are very different from, say, a logistics or heavy manufacturing business. It requires different levels of value-add expertise as an investor and different return expectations. But that doesn’t mean it’s impossible to accomplish.

So before you start a company and you think “but I don’t want to go raise venture capital” - stop and think about if that’s really the only path toward success. And if you are investor thinking about investing in a technology company, realize that not all of them are the AirBnB’s and WeWork’s of the world.

The Race for Midwest Venture Capital Supremacy Just Got Started

If you read my previous letter, you know that I think that the Midwest has massive potential in the technology investing space - the venture capital opportunity is way bigger than even some of the most entrenched cheerleaders in the area would lead you to believe. The data backs up that theory, and now, with some of the massive exits that have occurred / are going to occur, that theory is starting to play out in real time. And, like I have also mentioned in the past, those big returns are going to start attracting more investors to the area.

There is a flywheel that occurs in regions and industries that experience investment success. Smart business models (in this case, early-stage technology investing) beget strong returns. These strong returns (big exits) encourage more people to invest more money in these smart business models. And with more money flowing into this specific space, than then it is likely that more exits will occur, encouraging more investment, and so on and so forth.

Right now we are in the first - maybe second - spin of that flywheel. There are some investors who are pouring money in at the top of the rotation, but not nearly enough. In Silicon Valley, when this flywheel started turning, a lot of the folks who started re-investing in the region were former employees / founders who had benefited from those big exits by working at those companies. It was too early in the venture capital asset class’s history for a lot of professional investors to recognize what was going on (we are way past that point now, obviously).

In the Midwest, there will continue to be a proliferation of smart angel investors who spin out of successful tech companies. I had the pleasure of working with / investing in some of the companies who had this background while I was at Rev1. I also think that, because Venture Capital is an investment class that is more reputable / understandable than it was 20 years ago, it won’t just be former tech company employees who will be leading this charge in tech investing moving forward.

There are some investors in the region who are doing things super well already. But nobody has yet planted their flag as the emperor-supreme. Some folks have an awesome head start, but there are so many great companies yet to be built that any competitive / structural advantage (more capital, better brand name, stronger networks, etc) are fleeting. I suspect that some of the current leaders in the clubhouse will go on and be long term winners, but I think some of the future household Midwest VC names are still relatively obscure. Just because you manage a microfund today does not mean you will be in the microfund business for the rest of your career. The race is just getting started.

Cincinnati > Columbus

I wrote about 700 words on this topic and decided I was going overboard. It was less about Columbus being bad (it’s not, it’s a great town) and more about how incredible Cincinnati is. If you want to hear me wax poetic about the virtues of the Queen City, let me know and I can go on for days. I loved my time in Columbus - the people I met, the things I did, the memories I made, etc. But I love Cincinnati way more. I am excited to move home.

Friday Links

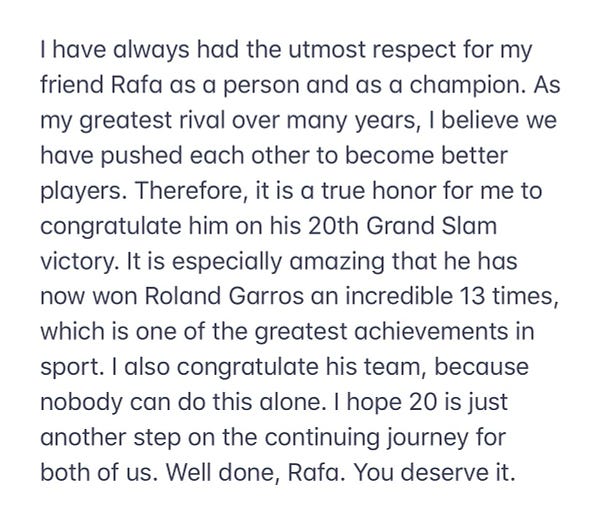

No real links this week. My wife and I closed on a house, so I was a little distracted. Instead, see below for a tweet Roger Federer sent out about Rafa Nadal’s recent French Open. (This is how I feel Cincinnati + Columbus should treat each other).