Newsletter and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice. Opinions contained within this letter are my own and not those of my employer.

There has been a lot of talk since the start of the COVID-19 pandemic about what has happened, what is happening, and what will happen to our economy. Policy decisions and personal decisions alike have been made trying to ensure that the impact of this scourge is minimized as much as possible. Of course, there’s no way that the impact could be avoided entirely - our entire way of life has been changed radically in an extremely short period of time. This has caused shocks to the system that are unavoidable. And a popular economic question of the time has been whether or not any of these shocks were avoidable or could be avoided in the future.

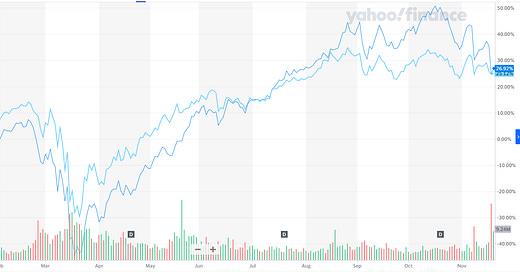

Regardless on where you land on that question, you can’t deny that things have changed. There has been a lot of talk, especially recently with the announcement of promising vaccine news, about the shape of the recovery. Some believe it will occur in a v-shape or a a nike swoosh shape. Others are claiming that we are currently experiencing a K-Shaped economic recovery. The thing these all have in common is that they are all moderately controversial.

And while it might be an academic use of time try to explain the entirety of our economy with just one shape, the reality is that there are multi-various economies moving in all different directions. Some of these movements are fairly obvious - airlines, restaurants, and hospitality have all had the crap beaten out of them and are vectors pointing straight down. Others are somewhat surprising: certain discretionary purchases (that normally get beat up during a recession) are blowing up - home improvement retailers like Lowes and Home Depot are riding the bull.

Part of this is intuitive if you think about the circumstances of the economic downturn we are currently experiencing: the impetus for reduced output was because workplaces suddenly became potentially dangerous and as a result everyone who could afford to do so started working from home. Naturally, the more time people spent at home, the more they wanted to make improvements. Same could be said for a lot of consumer discretionary purchases that replaced other purchase categories. For instance, premium TV sales have outpaced sales from 2019. And while it’s hard to say that is completely because movie theaters are shut down, it’s hard to deny that the lack of in-person events has led to an increase in the importance of in-home entertainment. (Interestingly, overall TV sales are likely going to end the year in a decline compared to 2019, due likely to a drop-off in sales in the budget television category.)

So what is causing these shifts? For an economy as big and complex as the United States, there are always many layers driving any major shifts. The first and foremost is that more people are spending time at home. At the beginning of the Summer, economists estimated that nearly 42% of employable adults in the US were working from home in whatever capacity their job deemed fit. On top of that, some economists estimate that nearly 33% of employable adults were unemployed - meaning that a huge chunk of the labor force were suddenly, and abruptly, spending all of their time - free or not, in their primary domicile. While some effects of this are economically logical simply from a supply and demand perspective (we all needed more toilet paper at home because we couldn’t take any poops at the office anymore), some of them are a little more psychological. Spending all day staring at that backyard project that’s half-finished convinces you to go to Home Depot and finally finish it.

And when it comes to goods vs. services, you almost implicitly break those two things apart into at-home and away-from-home categories. Goods are things you use at home. Or put on at home. Or keep in your home. Services are thing that you leave your home to experience, enjoy, or endure. And while there are home-services, those are really just ways of improving your most prized possession: your home. (I should note that home hear is not just the standard single family home - it’s really any domicile because even apartments have become prized pieces of intangible “net worth” at this point). So home services are just really elaborate, bespoke goods that you are buying for your home.

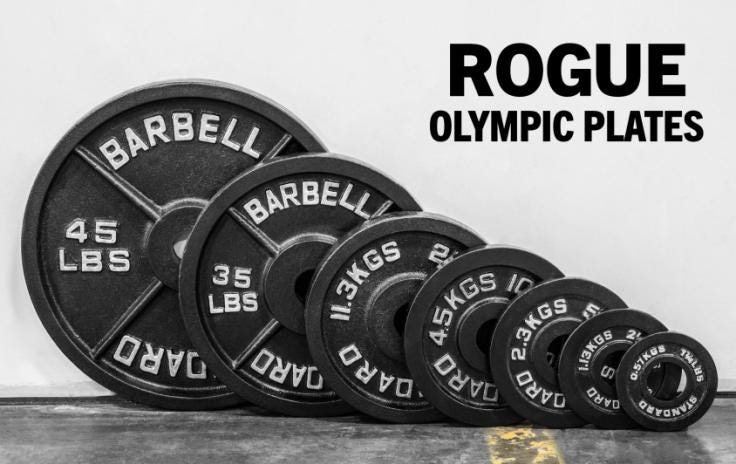

Normally during a recession discretionary purchases like this take a huge hit. And normally that is very true, but in the instance of the COVID-19 Downturn, this time it’s different. Part of this has to do with government subsidies and stimulus packages, the degree to which they are efficacious is somewhat up for debate and can’t truly be known for a while. But another big piece of the pie is that a demand shock for services that you can’t receive while wearing a mask have turned into a supply shock for goods you can bring home. In other words: people can’t spend money going to the movies, so they use that cash they didn’t spend and buy a new TV. My personal example: I could no longer go to the gym, so I stopped spending money there. But I still needed to workout and my physical fitness could not subsist solely on running - so I turned to lifting weights at home. As a result, I have been able to justify purchasing a lot of workout equipment. And I am not the only person experiencing this specific phenomena: try going to Rogue Fitness’s website and buying a weight plate - it’s hilariously impossible.

And while a lot of people are out of work and their ability to purchase home goods has been slashed, even they are not spending on services. So anything they may have that’s incremental toward consumer spending is going directly toward consumer goods, not services. Plus, the majority of employable adults are still employed. The labor situation is grim, don’t get me wrong, but it’s not quite end-times. (I am terrified of the long-term effects of the current labor market, however.) So while the typical factors that beat up consumer discretionary-goods spending (reduced macro income, fear-saving, etc.) have not been as impactful as they normally are. And it’s not like when the folks who started working from home were able to turn on that switch immediately - there we some expenses that needed to build the basic infrastructure for a work-from-home lifestyle.

The Software Angle

As already discussed, spending time at home meant spending money at home. If you were around that half-finished basement project all of the time, you would go on and finish the project because that’s just human nature. You spend money where you spend time. But it’s not just about physical time-spent either - a big chunk of time switched online / digital in a massive way. As a result, if you are a manager and were meaning to get around to upgrading your firm’s tech-stack eventually but never got that task across the finish line, COVID-19 was a useful catalyst in motivating you - it forced a sink-or-swim moment. So while Johnny Consumer was spending money on his backyard, Suzie CXO was spending money to finally invest in a better Zoom subscription, internal chat system, etc.

That technology project’s expense is magnified by a factor of how much your company relies upon technology. So if you are Zoom, and you have a laundry list of projects you need to work on, but your customer base of early adopters and tech-savvy managers suddenly turns into a customer base of everyone-and-their-mother, those projects all become much more important. As more people use a digital tool, more is required of said tool. For software companies, as the customer base grows, the product needs to become more and more scale-able. And while a lot of software products like to think they are easily scale-able from day-one, there is always room for improvement. Pre-COVID, that improvement was made quickly as the customer base grew, over the course of a couple of years. That was break-neck speed and required impressive talent, but it was a possible task. Post-COVID, when that customer base blew up, those improvements needed to happen in months, sometimes days, and required heavy spending.

However, why are we talking about Zoom - that’s not a product, it’s Software-as-a-SERVICE, right?! SaaS is a business model that delivers a product to customers. Most SaaS companies are experiencing the upward Goods Economic Bull Run because they are goods themselves. Selling bits instead of atoms, but goods all the same.

Having too many customers too quickly is an awesome problem to have. More people are coming to buy your product so it needs to be improved. I am not saying it’s an easy one to solve, but I think all good business managers want that problem. The flipside of that problem is that your customer base has shifted where they are spending their time, so your existing marketing channels and sales methods are suddenly obsolete or ineffective (read: Grocery Stores). If you are Kroger, your customer base and demand has increased, however, most customers have trouble actually getting to your product. You need to solve the same problem as Zoom (increased demand), but instead of just trying to capture new customers, you are trying to retain most of the same ones.

The question, for companies on all sides of the technological spectrum is how much of the on-going shift in behavior is here to stay, and how much of it is purely temporary. From there, they can decide how much they need to invest in technology. If they invest too little, competitors will snap up market-share pretty quickly because they provide a more ergonomic good. If they invest too much, and some of that investment goes to waste, then the Company suffers because it could have used those investment dollars elsewhere. If Kroger doesn’t create online ordering capabilities, but all of the other grocers do, then more consumers will switch to those new grocers and likely never return to Kroger. If Zoom overbuilds it’s product and a lot of it’s customers stop using it’s product, then it’s margins could erode in the long-run.

Do I think either of those things have happened? Seems unlikely. I think video-conferencing is here to stay in some form or another. I think online grocery ordering seems like an eventuality. Beyond that, I am still trying to wrap my head around what behaviors will be long-term, and which are just temporary. I know that some behaviors I have picked up in 2020 are going to stick around for a while (I have realized how much I hate commercial gyms), while others will vanish as soon as possible (having food delivered on date night instead of going to a restaurant sucks big time).

Monday Links

Founder’s Field Guide: Nick Kokonas

One of the better podcasts I have listened to recently. Kokonas is a legend in the restaurant industry and has a fascinating worldview. His restaurants have faced hardships during the pandemic and the way he has responded is impressive.

Levels is one of the more interesting wearables companies out there right now. I am a big believer in the importance of understanding the impact of sugar, glucose, fructose, etc. has on our bodies. I am fascinated to watch how this company grows and evolves and how they can help people understand their bodies more fully.

If you are looking for a bull-thesis on remote work, this is probably a good place to start. Not sure I agree with a lot of the assertions made or the overarching argument, even, but it will at least get your thoughts flowing.