Disclaimer: Newsletter and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice. Opinions contained within this letter are my own and not those of my employer.

By this point, if you still haven’t paid any attention to Bitcoin, I encourage you to do so. Not because I think it is going to be the currency of the future, or because it is going to radically replace the banking system as we know it, or because it’s a great investment. [Depending on when you bought, it was the best investment over the past ten years, but that’s beside the point.] I make a general rule of paying attention to anything that has this much money being thrown at it and stirs up this much fervor because that’s where some of the best real-time financial lessons can be made.

Sometimes events occur in real time and you get to witness them and learn more than you ever thought possible. I learned more about short squeezes in the month of January 2021 than I could have possibly ever learned from any book or class. That was all thanks to $GME, $AMC, and folks like Roaring Kitty making a massive impact on the financial markets. Stated differently: when you see a car crash happen in real time, it’s much harder to forget than when you hear about it from a friend.

When it comes to Bitcoin, I have had trouble trying to fully wrap my head around the concept. There are things that make a modicum of sense - back in my VC days, I was able to somewhat understand the idea of blockchain technology - and then there are things that just don’t add up. As any diligent former econ student would, I have tried to read up about the OG cryptocurrency - if it is really going to radicalize our monetary system, I don’t want to get caught flat-footed. I have even purchased some crypto just to have some skin in the game and better appreciate its staggering appreciation.

But through all of my research, one of my biggest conclusions has been that we don’t really know what is going to become of Bitcoin because we haven’t really seen it in action. It has a lot of theoretical use-cases, but most of them haven’t been put into action, with the exception of speculation, but that hardly proves that it is going to alter the course of the monetary system for good. If it ends up being all that its chief evangelizers say that it is going to be, it’s going to be a platform on which great wealth is built, and not the actual wealth-creator it looks like today. A great analogy would be how the internet launched millions of businesses and revolutionized an economy, but nobody actually made money off the internet itself. It is the just the platform on which everything else was built. However, it’s hard to know if that is actually true, or just some HODL-er’s pipe dream. In order to really understand Bitcoin’s potential, we would need a good real-world experiment - a business that was built on the back of bitcoin, leading the charge for showing us what cryptocurrency is capable of.

Enter: Coinbase.

Coinbase S-1 Review

Coinbase is a massive fintech based nowhere that is focused on creating a “an open financial system for the world .” The Company was founded in 2012 with the purpose of better facilitating crypto trades and storage of crypto assets. It was initially only focused on Bitcoin (because that’s effectively all that existed at the time), but it has since grown to include basically every cryptocurrency on the planet, and then some. Coinbase is effectively the banking app for Bitcoin.

When you first crack open the Coinbase S-1, there is some pretty lofty language included in their description. In typical high-flying startup fashion, they claim things like “Create an open financial system for the world” and “More economic freedom for every person and business”. But they also hit you with some of their hard facts right away too, like “$90 billion assets on platform” and “$456 billion lifetime trading volume”. [For reference Fidelity has $8 trillion of assets under management.]

The Company also hits you with a pretty lengthy glossary of terms such as “security token”, “smart contract”, and “address”. While I am not going to waste my time trying to explain how blockchain and cryptocurrency actually function (because there are a million better resources than this newsletter), I do think it’s remarkable how complicated and jargon-y insiders continue to make that industry. If they want to achieve mainstream success, it would seem they need to reduce barriers to entry. However, whenever I talk to a real crypto-head, they seem to take the opposite approach - this technology is so powerful that everyone will have to learn all the jargon eventually anyway, so no reason to dumb it down.

An important piece of jargon laden throughout the S-1 is talk of the “cryptoeconomy”, the term they use to describe using cryptocurrency for engaging in any sort of economic act - trade, speculate, earn, spend, save, borrow, lend, vote, etc. Coinbase’s main pitch is that they are going to be the central locus through which this entire crypoteconomy will flow through. In their minds, they are going to be an easy-to-use platform that anybody can access, while also being safe and trusted. They even outright admit that the central flaw for most crypto is that it is “much too difficult to use for the average person”. Coinbase’s goal is to be the bridge for that gap.

However, this requires some deft maneuvering because the primary function and value-prop of crypto is how safe, reliable and immutable it is. A single Bitcoin is interesting because it cannot be manipulated, nor can it be defrauded. But adding a layer of software on top of it that makes it easier to use does increase a cryptocurrency’s risk factors, however slight. Thus, Coinbase is making a claim that they are going to be the ones who can manage and maintain crypto in the purest of forms. While I don’t know if that’s a big or small risk inherent in this company, it certainly is one to be aware of. What you gain in ease-of-use, you might lose in integrity of product. That is still to-be-determined.

While this risk is small at the moment, it does provide potential tail-risk situations that could be disastrous, such as what occurred with Mt. Gox. However, the Company has several things going for it that mitigate some of it’s biggest potential future headaches. For one, it has users, and lots of them. The platform enables 43 million retail users, 7,000 institutions, and 115,000 ecosystem partners. Since inception, the Company has generated $3.4 billion in total revenue, mostly from transaction fees from volume-based trades.

The Company has scale and size that would make it tough for a challenger to break into the space and compete. While it may seem obvious, it’s unlikely that a more traditional bank would ever try and get into crypto in this manner any time soon - most of them are either actively denouncing it or have accepted it, but treat it as a side show. Plus, most crypto enthusiasts believe that one of the main objectives of the technology is to disrupt the existing banking system.

There are other cryto platforms that allow you to buy, sell and use the product, but none of them have the scale or capabilities that Coinbase has yet. Of course, the internet age is full of early leads being lost to younger challengers (Amazon vs. eBay, Facebook vs. Myspace, etc.), but Coinbase’s brand is very powerful in the market. They have the lead right now and would have to screw things up to lose it. Their competitors are probably a sign that there is real demand for this product. The utopic cryptoeconomy that they espouse still has a long way to go, so you never know what could happen, but they are in the driver’s seat.

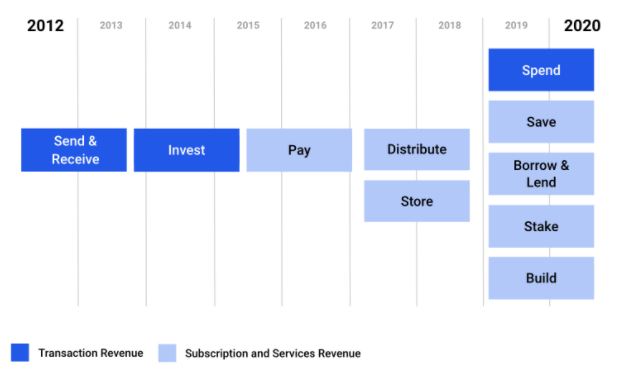

And maybe most importantly for the the financial markets, Coinbase is making a ton of money and is profitable. Revenue more than doubled in 2020 from 2019, from $533 million to $1.27 billion and profit turned positive, reaching $322 million for the FYE 2020 period. While I don’t expect the Company to maintain profitability in the near term - they are likely going to aggressively reinvest to maintain their lead in the market - it speaks volumes that they are able to turn a profit at all at this point in such an unproven market. But that might be the point - while some might say that the cryptoeconomy has a long way to go before reaching maturity, it is entirely possible that certain crypto use cases have already matured. The “trade, speculate, earn” portion of the use case spectrum might already be fully formed if 43 million people and 7,000 institutions are already on board. If Coinbase can be the de-facto platform for the next wave of use cases - “spend, save, borrow, lend, vote, etc.” - then they will be a force to be reckoned with.

Regarding some of those maturing use-cases, transaction volume accounts for ~96% of revenue. This tells us a lot about the Company’s future use cases, as they are paid for using subscription products. As a result, we know they are not super popular yet.

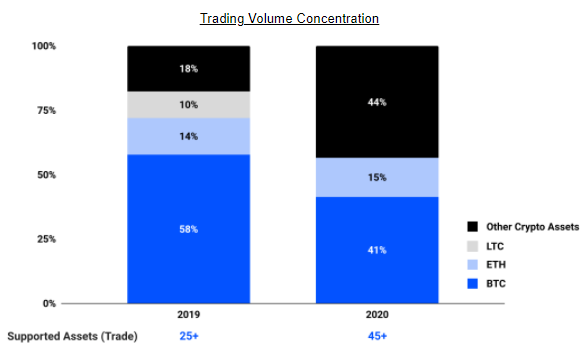

Even when you dig into the Company’s Invest use case, it appears that Bitcoin is a big piece of the pie. If you are long Bitcoin, that’s not troublesome news, but if you simply view Bitcoin as the Netscape of Cryptocurrency, it might cause some concern.

However, the Company has been able to diversify away from just being a BTC platform:

There is some cause for pause that they only had such a good year because of the obscene trading volume that occurred across the board for retail investors. The optimistic take is that in the event that crypto stops trading wildly and instead becomes more of an actual currency, Coinbase will make up for that investment transaction revenue by making subscription revenue in their other use cases - their take rate when crypto actually is used to pay for something.

Analyzing the S-1 for Coinbase generally leads to more questions than answers. The biggest, overarching question is whether or not the cryptoeconomy will come to fruition at any scale. Of course, that’s impossible to know right now, but if that is the case, Coinbase is in a great position to win that market.

Bear Case:

Cryptocurrency is not actually the economic equivalent of tectonic plates shifting and the cryptoeconomy fails to materialize.

Coinbase is just the first iteration in a much longer game of building the cryptoeconomy and some other company we likely haven’t even heard of is going to do it better soon.

Government regulation. Traditionally I would say this isn’t a risk because crypto is specifically designed to route-around government currency. But Coinbase is still regulated by government entities and they might make an example of the a company peddling product that seeks to undermine their financial power.

The tech market is just way to high right now and the price is inflated beyond any reasonable measure.

Bull Case:

If Bitcoin is anything at all, there’s a good chance that it is massive and like the internet, will be a very disruptive force, mostly for good. Likely though, we will spend less time talking about “bitcoin” and more about the things that are built on or around bitcoin, much like how the internet is today. Nobody sits around and talks about the interworking’s of the world wide web - they talk about platforms and technologies built because of the internet. Coinbase very well could be the Google of the financial system.