AcuityMD and The State of Commercial Intelligence Tools

What Do SaaS Companies Look Like in 2024?

Disclaimer: Newsletter and the information contained herein is not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice. Opinions contained within this letter are my own and not those of my employer.

PROCESS

What is AcuityMD? It bills itself as a commercial intelligence platform that is tailored toward the medical device industry or “medtech software that drives sales”. The Company claims to transform large amounts of healthcare data into intuitive workflows. Another example of a commercial intelligence platform: Pitchbook. Most finance professionals use Pitchbook to look up deals, track comps data, and find out what is going on in rather opaque markets.

It’s not enough to just track your ongoing relationships with customers, you also need to use data to find new customers, relate to your customers better, prioritize customers more effectively, and know where to invest into customer relationships. Pitchbook is the gold standard for the private investing industry. AcuityMD is trying to be the same for the medical device industry.

Pitchbook is a fun metaphor for a venture-backed company, because most VCs likely have a Pitchbook subscription. They know how the product is used, how fundamental it can be for a company, and how hard it can be to maintain data at that scale. But part of the trick with something like AcuityMD is the data source.

The medical industry’s data is so jacked up, that the government has had to regulate data sharing pretty heavily (transparency in pricing rule, for example). In fact, there are dozens and dozens of companies that are trying to take advantage of this new data regulatory environment.

But it’s not just about the data that has been regulated into existence, but also the flow of data in the industry. Because of HIPAA and other factors unique to the healthcare industry, data almost never flows the way you think it should. Most people know this intuitively because of standard human healthcare experiences. Isn’t it strange that you have to fill out the same form every time you go to get your annual physical? Or to get your teeth cleaned?

If I am doing a bad job of explaining how complicated the data situation is in healthcare, that’s because I am not sure I can even really explain it - it’s that bad. On that topic, here is an interesting quote about AcuityMD’s market specifically: “What was fascinating to me is that the manufacturer holds a lot of information about what to use, [and] sometimes that didn’t get disseminated to the right surgeon at the right point of time,” … “The fundamental realization I had was that the information flow in this industry was a little bit broken…It wasn’t an issue of being competent doctors or surgeons, but a lack of information transfer, which is kind of crazy in a data-driven world.”

So the data issue is a big problem. But how do you solve it? For AcuityMD, like most enterprise grade tools, it’s important to nail the product experience - make sure that the features and functions actually fits into a professional’s work style. But maybe more importantly, the Company needs to actually nail novel data. Pro organizations, as opposed to the junior varsity ones, aren’t buying tools like this simply because the UI is nice. They have teams of people to throw at the UI if it’s a problem. They want it because they think it can give them an edge. And it can only give them an edge if it’s:

Accurate

Up-to-date

Unique

Actionable

But what does that actually mean?

The product is broken out into four key categories:

Targeting - The platform offers a feed of healthcare providers (HCPs) and sites of care (SOCs), including their procedure volumes, affiliated networks, and historical product usage. Critically, it is integrated with existing CRMs and internal data resources to even further enhance a customer’s understanding of their customers. Users can find data like introduction signals (who certain KOLs are connected to) as well as the types of procedures certain healthcare providers operate and to what frequency they operate.

Markets - enables medical device companies to define, size, and segment their target markets. Users can search a CPT code and find an estimated market size based on that indication. A good question would be how this actual market size is calculated at scale.

Territories - allows the data to be cross referenced geographically. A basic, but important feature, especially for field sales reps.

Pipeline - automatically identifies potential sales targets and puts them into a customer’s workflow. This is a leads generator, which can be very beneficial to a sales team if the leads are any good. From the website: Customers can build sales forecasts, identify gaps in quota, and guide sales representatives to effectively fill their pipelines. It offers a full view of the sales cycle, from initial targeting to customer engagement, and tracks product usage and opportunities across various customer types and categories.

Care Journeys - breaks its data into longitudinal patient-level data, meaning you can track how folks diagnosed with certain diseases, indications, or symptoms flow through the care continuum. On top of that, a rep can see which HCPs patients are sent to, as well as where patients finish their care journey. This allows for “patient leakage” to be detected - which can be a powerful tool when selling to various sites. It can also help customers find complex patients. These all help a customer sell its product to the right people at the right time. If they better know where the problem and use case is, they can better sell their product.

Contracts - allows for customers to view which contracts of theirs are adequately being acted upon. Just because an HCP is contracted to use a medical device, it doesn’t necessarily mean that they will. It is very hard to change a doctor’s behavior, even if it means better patient outcomes. This is possible because AcuityMD has a Contracts Repository that they run analytics on top off.

Of all of those features, Pipeline is the one that seems to have the most juice. If done effectively, it can automatically start filling a sales rep’s bucket with the right kinds of people to go after. Of course, if done correctly is doing a lot of heavy lifting in that sentence. But that is where the value really comes from - filling the pipeline - and as a result, a sales rep’s time - more effectively.

Although, the most recently released Contracts feature shows the power of this platform and maybe what makes this such an interesting bet. They are crossing the threshold from data analytics provider, to actual repository of customer internal data. Having contracts stored and managed within their product makes them eminently stickier. On top of that, it also provides an exceptionally novel data source that is deeply valuable and complex. In the age of AI, that is a gold mine.

If they are going to generate any solid data network effects, I anticipate that is going to come from the Contracts product, more than anything else. Because not only does it tell them important data about how a customer’s product is used, but it helps them baseline interesting data across the entire industry. Customers are uploading their own contracts, which is inherently a novel data source. As more contracts are uploaded, the level of insights the Company can provide will only increase. As a result, as more people use that product, the more valuable it will become. Which will, in-turn, drive more customers on the platform. Theoretically.

PEOPLE

The core of our thesis at Refinery is that we are a people-first venture firm. Yeah, a lot of other venture firms say that they “put the entrepreneur first” or that they really focused on “backing incredible teams”, which is broadly pretty true, but what I have rarely seen in action is folks who are actually building a thesis around team. More often than not, you hear someone back a founder because of indescribable intangibles. And look, if you spend all day, every day, talking to founders, it’s pretty easy to start pattern matching what good and bad founders look like. So I get that - trust your gut, this job is a craft exercise, after all. You can’t do it purely by textbook as there isn’t one.

I was listening to the Acquired podcast recently and one thing they said is that the truth is, for the world-conquering type of companies that they normally podcast about (a recent episode was a four hour epic about Microsoft post Dot Com era), they are the exceptions, not the rules. They do things that other companies shouldn’t try because they would not get away with it. And in venture, if you are trying to back these kinds of companies, it’s really hard to just paint by numbers - there are no numbers!

This is why “Uber for X” became an proto-Venture Meme in the mid-to-late teens. It’s very hard to take a company’s strategy from one market and apply it to another. Markets are radically different from one another, and frequently, what works for one company won’t necessarily work for the next one because things just aren’t that linear.

But the reality is that experience is a great teacher. You need to know what hypergrowth looks like if you are trying to achieve hypergrowth. If you want to play in the big leagues, it behooves you to play a couple of seasons in the minors, at least. Sure there are some exceptions to that rule, but those folks are the rare examples. However, a trick here is that seeing hypergrowth can sometimes be a once-in-a-lifetime sort of event. Not because there aren’t that many hypergrowth companies (although, there aren’t), but because once you go through something like that, it can be hard to get back on the saddle. Maybe you made a ton of money on an exit and you aren’t motivated to work that hard. Or maybe you didn’t make any money (which happens to hypergrowth companies too!) and are burned out from that experience and just want to go do something stable. Whatever the reason, it’s a tough needle to thread to find that hypergrowth leader who is ready to get after it again.

Which brings me to the founding team of AcuityMD. Michael Monovoukas - the founder and CEO of the company - might be an interesting case study in hypergrowth success to startup founder success. I say might because it is always a little hard to track what companies experienced hypergrowth and which ones only have some of the signals. There are some signals that are generally pretty reliable - raise a Series B funding round, hire 200 people in a year, more than 4x’ing staff, exiting for a big number, etc. But the reality is that those are all just proxies. Hypergrowth can only really be calculated using one metric - REVENUE GROWTH.

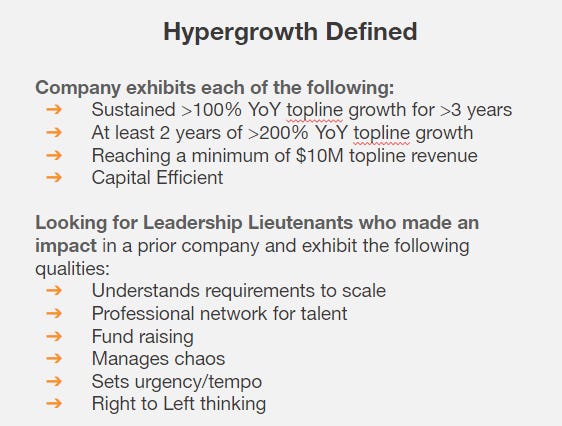

That’s what venture is all about. (before the 6 PE dudes who actually read my blog get worked up - the assumption is that your margins are good in venture. If they are bad, you never found product-market fit. If the margins stink, nothing matters, because you don’t have a company, you have a charity.) Quick refresher on the definition of hypergrowth:

So why is Michael interesting? He’s a Princeton (the one in New Jersey, not the one in Sharonville) grad, Bain consultant who spent a lot of time working in the medical device industry. But honestly, that’s a somewhat milquetoast background for a founder. No offense to Princeton grads (NJ, not Sharonville) or Bain Consultants, but I can’t imagine there is awesome data that backs up those backgrounds leading to excellent, once-in-a-generation venture scale returns. Of course, people who do that stuff tend to be smart and work hard, but as we know well, being smart and working hard are only a part of the equation for being a good startup founder.

No, what makes him interesting are his failures. First he tried to start a company after spending a couple of years at Bain and failed. More importantly, it was a med device startup called WoundStylus. He said he used that experience to learn how to sell to doctors and other folks in the medical profession. Failure is a great teacher.

After that, he went and worked for a company called PatientPing. Unfortunately, there isn’t a ton of data out there about PatientPing. However, it did get acquired by Apriss - Now Bamboo Health. It was backed by some interesting venture firms and it had raised a Series A (at least, and I think maybe more, but hard to say). I love it when my portfolio companies hire a founder who just wound (pun unintended) down their company. Why? Because hungry dogs run faster. What’s even more interesting is what he was doing there. His linkedin states the following:

Financial responsibilities ranged from leading strategic work (fundraising strategy, pitch deck creation, financial forecasting, and operating model development) to building operating processes into a fast growing company (preparing monthly GAAP financials, managing A/R and billing, leading annual audit and tax preparation). Also managed a pipeline of business development opportunities to help grow the PatientPing community by adding new sources of data and opening new distribution channels for the salesforce to develop.

He probably got hired as a finance guy (Bain Consultant, etc. etc.) and then found his way onto different strategic roles. He worked very closely with management most likely and got a front row seat to what a fast growing company looked like. He had influence. And when the company sold, he might have gotten to even meet some of the folks who make decisions like that. Strategic acquisitions are always unique, but they do let you meet more strategic buyers than you might regularly imagine. That’s a really good network to build.

After that, he went back to Bain and then teamed up with fellow Princeton (NJ, not Sharonville) grad Robert Coe. Coe’s background is maybe less thrilling than Michael’s, but still impressive. He started his career in banking and then spent several years at Yext - a company this space knows very well. While neither of those contribute to hypergrowth experience, he did not just spend all day slamming lines of code. It looks like he spent more time in customer-facing roles, being a technical sales person and implementation expert. That’s always helpful for CTOs because they frequently are spending more time managing teams, vendors, and partnerships, than they are making sure the code base is super dope.

One small footnote that probably gave him some unique experience is that he was hired at Yext right before that company’s IPO. So he knows what it is like to spike the football. He has seen success at that level and deeply understands what a professional organization will look like at that stage.

The Third Co-Founder is Lee Smith, aka the Wonk, a frequently overlooked component of the hacker, hustler, and hipster triarchy. The reality is that hipster (WOW what a 2012 phrase) makes the most sense for consumer tech. And while I want my enterprise tech to be cool, the reality is that cool for a specific industry - say medical devices - can come in lots of different shapes and sizes. And you need a wonk to tell you what cool is in that industry. I believe that’s where our guy Mr. Smith comes into play. I haven’t found it, but I am guessing he was working for a company that had hired Michael’s Bain consulting outfit at one point and they got along. Sadly, he did not attend Princeton, so I am out of Spencer Ware highlights to share.

One thing I would love to know is how involved he is in influential decisions today. Frequently, if a wonk is REALLY good, they become one of two things: head of product or head of strategy. For startups, strategy can be a dangerous role to be in. It is, after all, 95% about execution and only 5% about strategy. Mr Smith is head of commercial development. One of those cool titles that could probably mean anything.

They do have some other hypergrowth fellas around the table as well, like Ross Feinstein (first 10 at Flatiron is sick sick sick), Brittany Macaulay (Veeva), and Rob Bergland (probably not hypergrowth, but man I love Ruggable).

It’s a cool team. On paper, I would back them.

TECHNOLOGY

So the thing about data products is that they are rarely inherently technologically differentiated. You are selling data, what’s so compelling about that? What can be compelling, however, is the ability to generate, calculate, capture, manipulate, analyze, or imbue some sort of mystical aura onto said data. Plain old data is only worth what the buyer of the data is able to do with it.

Additionally, if others can capture this data, then it can become a commodity, regardless of how hard it is to capture today. In fact, a moores-lawsian theory of the internet is that all third-party data will eventually become a commodity. It’s only first party and second party data that can be compelling over the long term. So if a company has some way to capture that data in a novel way, that can be turned into a sustainable, long-term advantage. So it’s really about the technology and process to gather, analyze, and enhance data that is exciting. Let’s break those three points down

Gather Data - web scraping is the first thing that comes to mind. Of course, this can be really easy to do, or really hard to do, depending on what is actually being scraped. But it’s not something that I think has a strong moat. The web is OUT THERE. If people are motivated to do so economically, they will scrape its data. But there are other non-scraping data sources that are more compelling, like first party generation. A good example would be the data Tiktok gathers from its users’ behavior to build a better algorithmic feed for those users. Nobody else can get Tiktok’s data, because they are not Tiktok (deeply ironic example).

Analyze Data - sometimes data is easy to find, but hard to actually understand. Maybe that’s because it’s so robust. Or maybe it’s because the data is deeply technical, and only someone with a strong understanding of the space can really interpret it. Or maybe understanding the data requires a very sophisticated, self-referential model. Example: Transparency in Pricing Rule. This rule is great, but the data set is so enormous and opaque, that when it gets published, it requires deep process power to really interpret it. Analyzing data is really just making it readable.

Enhance Data - Taking a data source and finding a way to make it more actionable. Unlike analyzing data, where you are simply taking data that is hard to interpret and finding a way to interpret it, this is the act of taking data and making it more useful / effective. A simple example is customer data that doesn’t have emails associated with it, and using some process, finding a way to match those emails with the correct customers.

So which of these is Acuity actively doing? It’s hard to tell exactly without taking a peak under the hood, but my guess is that they are trying to execute on all three.

They are gathering data in a novel way. Likely from surveys and responses from industry experts, etc, as well product usage data. On top of that, their Contracts product is probably a pretty rich trove of data as well.

The Company collects a lot of it’s data from CMS and medical claims aggregators, and then analyzes that data to make it readable. It’s not enough to just have that information, it needs to be actionable as well. The little I know about CMS data leads me to believe it doesn’t come out of the oven in a very accessible manner, even for folks with industry knowledge. Cleaning it takes some process power.

Enhancing data seems like their bread & butter. There are a LOT of data sources that they are pulling in from, and finding ways to make that manageable seems like the entire point. It’s not good enough that they know which hospital uses which types of medical devices or procedures, but also pairing that information with key buyer details is extremely valuable. It is very likely that their whole process is built around this idea.

There is likely a good argument to be made about the industry wave that’s going on in medical devices. There’s no doubt that it is becoming harder and harder to build and sell a medical device business these days, with the average cost of bringing a medical device to market being between $30 million and $54 million in 2022. A large part of this is due to the increased size of the market and the difficulty that is required to stand out in the crowd. As a result, the process of selling a med device can be very tricky. Add that onto the fact that healthcare data is becoming more and more complicated, the straightforward path to a sale doesn’t really exist in this industry anymore, despite it growing at a healthy clip.

And while I think some of their product falls into the “good data, slick UI” category, which isn’t exactly something to write home about, I do think they have a possibility of generating a data network effect. They get a lot of their data from CMS and medical claims aggregators. It’s hard to know how proprietary a lot of that is, if at all, but I am sure it’s pretty robust and hard to manage. Digging in further, you can find from their website: We partner directly with CMS and medical claims aggregators to harmonize, clean and surface insights from over 325 million patients in our all payor claims dataset. Turn disjointed data into intuitive workflows. Powered by data from over 325 million patients, AcuityMD focuses sales efforts on high-value opportunities that expand product adoption, and updates automatically when new information is available.

Again, a pretty big data set. But what’s compelling here is the fact that that data is then integrated into existing workflows, if done correctly. Which means that the Company is able to generate new, novel data. As folks integrate their data into their CRMs and workflows, the Company likely is able to glean insights from their customers, such as heatmaps where a lot of activity is taking place, internal signals on who are key people at different accounts / locations, etc.

That’s all cool and very web 2.0. However, with the Company’s new Contracts tool, they are getting a rich treasure trove of contracts from companies - which likely contain novel data found nowhere else on the market in an aggregated location. 15 years ago, you could have this store of data, but you wouldn’t be able to actually do anything with it because it would be so complex and disjointed. In 2024, that shouldn’t be an issue. I am not sure I have fully wrapped my head around that implication, but I have read my fair share of med device customer contracts, and they all contain a lot of interesting information. Combine them, and you might know more about the market than anyone else on the planet.

This could generate a serious Data Network Effect. As more customers use this product and upload more contracts to the Contracts tool, the Company will have more robust data on the market and will be able to generate better insights. As a result, these better insights will attract more customers onto the platform. And the cycle continues until this a product that you will have to use, no matter the price, if you are in the med device industry.

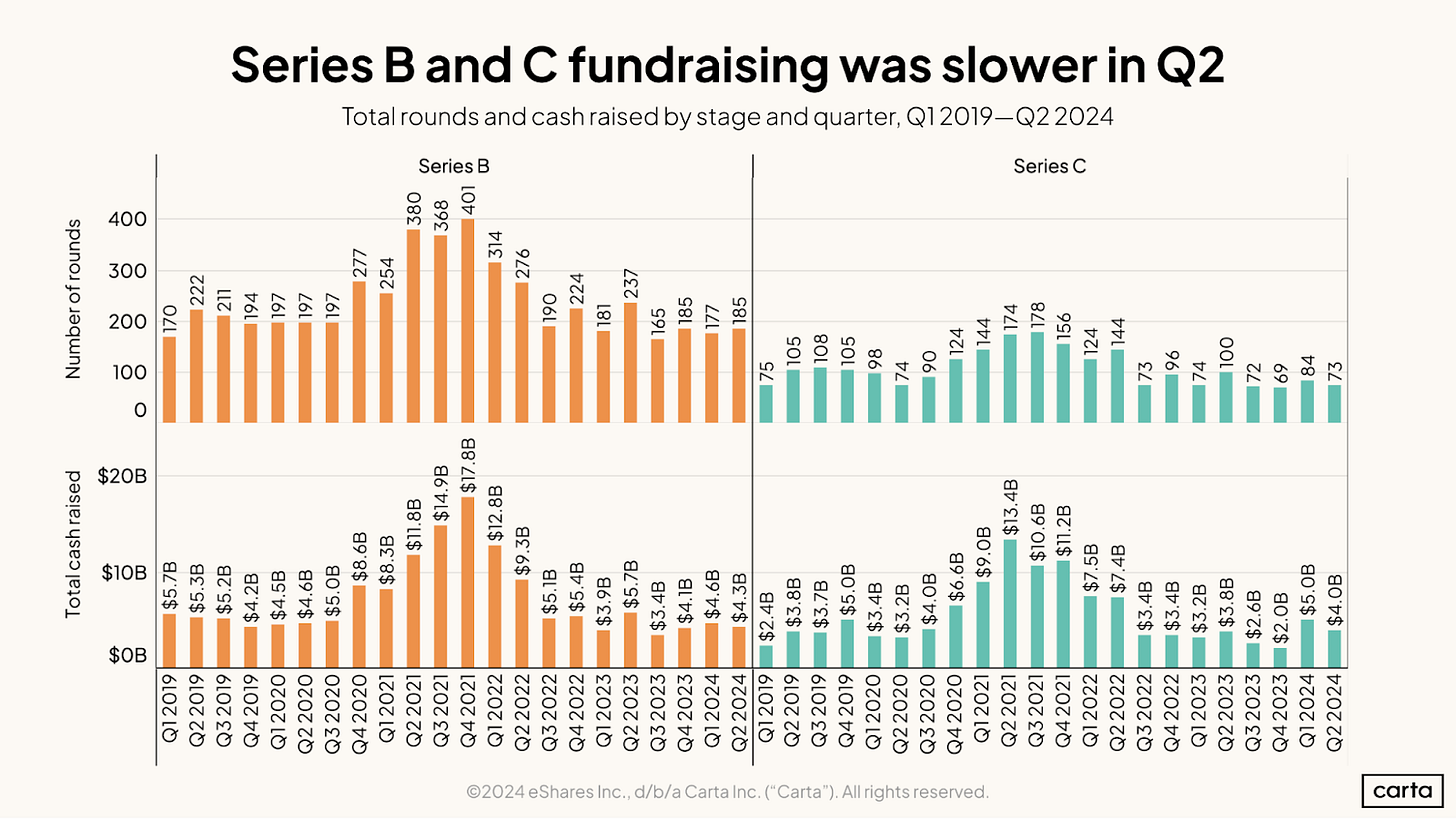

In Summary, why is this interesting? There just aren’t a lot of Series B’s being done in the healthcare industry at these kinds of valuations or capital raise amounts these days. Even on the coasts, they are pretty rare. See below from Carta’s Q2 2024 report:

And when you think about a lot of deal activity happening right now, a lot of it is flowing into AI. Practically half of all venture fundraising in the first half of 2024 flowed through just a handful of AI companies. So why double down on this one? Potentially a couple of reasons:

The company is just growing like a weed. VCs are back to basics, and just funding companies that are growing like crazy. I definitely think there is some truth to this. From the Company: In December 2022, AcuityMD reported an increase in ARR of 317%, with customer growth increasing by 253% over the same period, In August 2023, the company reported having 116 customers, with 50 signed in 2023. As of December 2023, AcuityMD claims its solution has generated over $4 billion in total pipeline and enables a 25% sales increase for active users.

That’s good growth. And depending on how big that number is, it could be face-meltingly good.

At a $500M valuation, do they have $50M of ARR (assuming a 10x multiple, which is sorta conservative, even today)? That seems somewhat hard to believe, but if the growth is there, I could see someone paying up.

The data network effect we described above is more potent than we realize. In the land of commoditized AI models (which may or may not be the reality), then the real gold mine is in the data. At least, that’s how the theory goes. If a company has a proprietary data moat, it will be very hard to kill them. And, like a lot of networks, this should hopefully provide some sort of acceleration as it gets bigger, not slowed growth.